Podcast Episodes

Back to Search

Why Doesn't The Economy Break?!

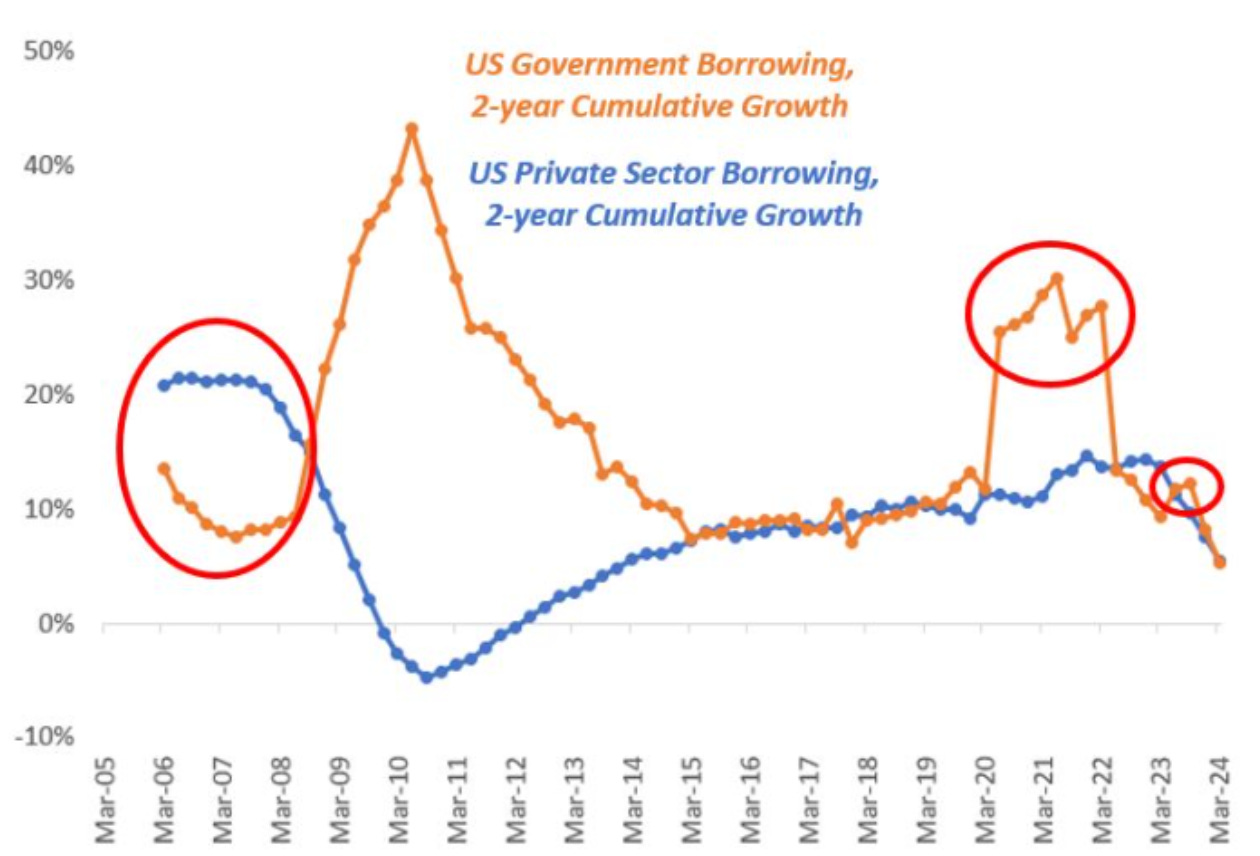

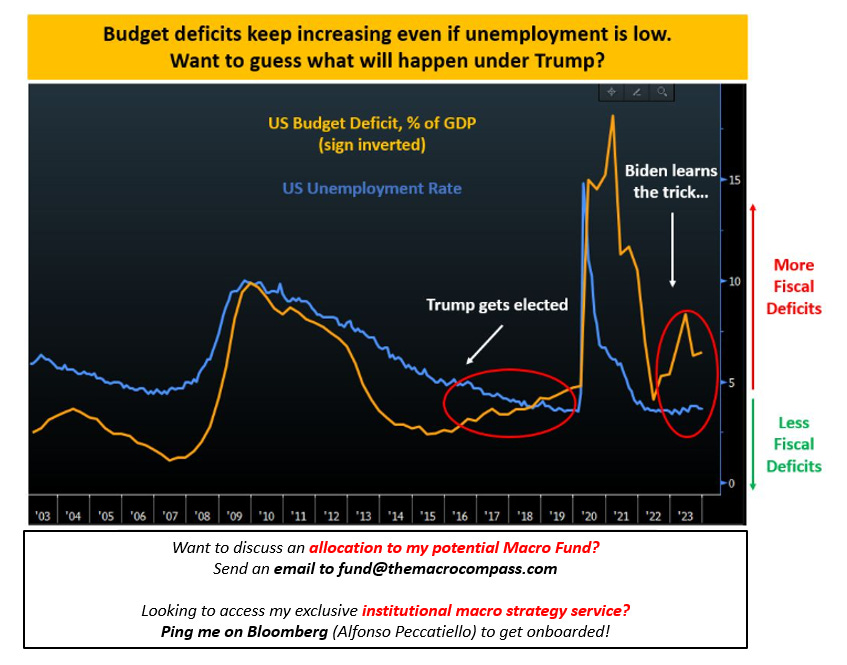

The Fed hiked rates above 5%, and yet the US economy doesn't break.

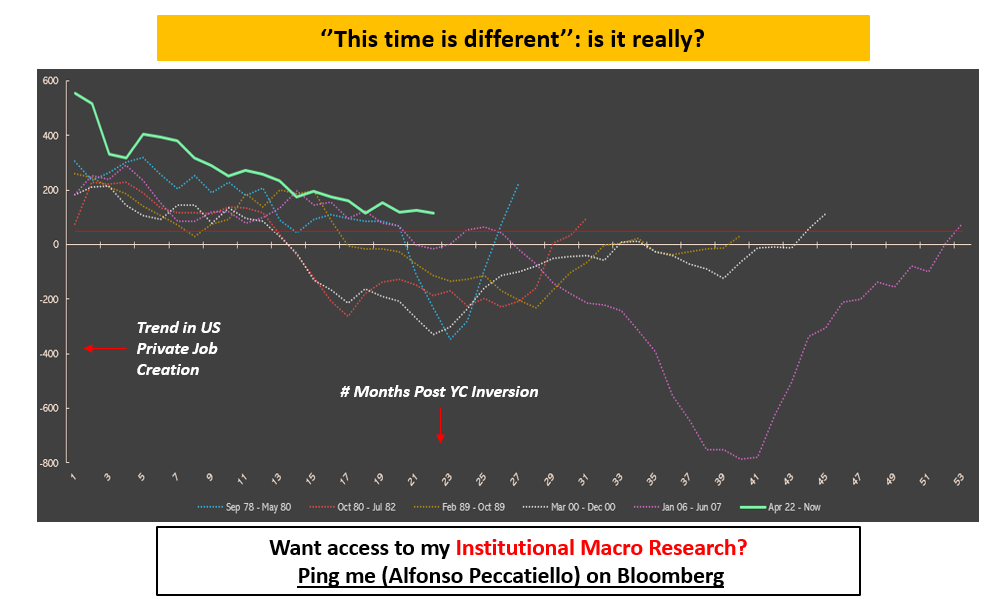

Back in 2022 already, the yield curve inverted and it has stayed inverted ever since.The lags looked relatively short, and the US ec…

Published on 1 year, 4 months ago

Yield Curve 101

When the yield curve flattens and eventually inverts, you worry.But it’s when a recession hits, the Fed cuts rates and the curve steepens that you become s**t scared.

Yield curve dynamics represent a …

Published on 1 year, 4 months ago

Tectonic Macro Shifts

Hey, this is Alf - welcome back to The Macro Compass!

Last week was big for macro and markets.

Today’s piece is going to cover:

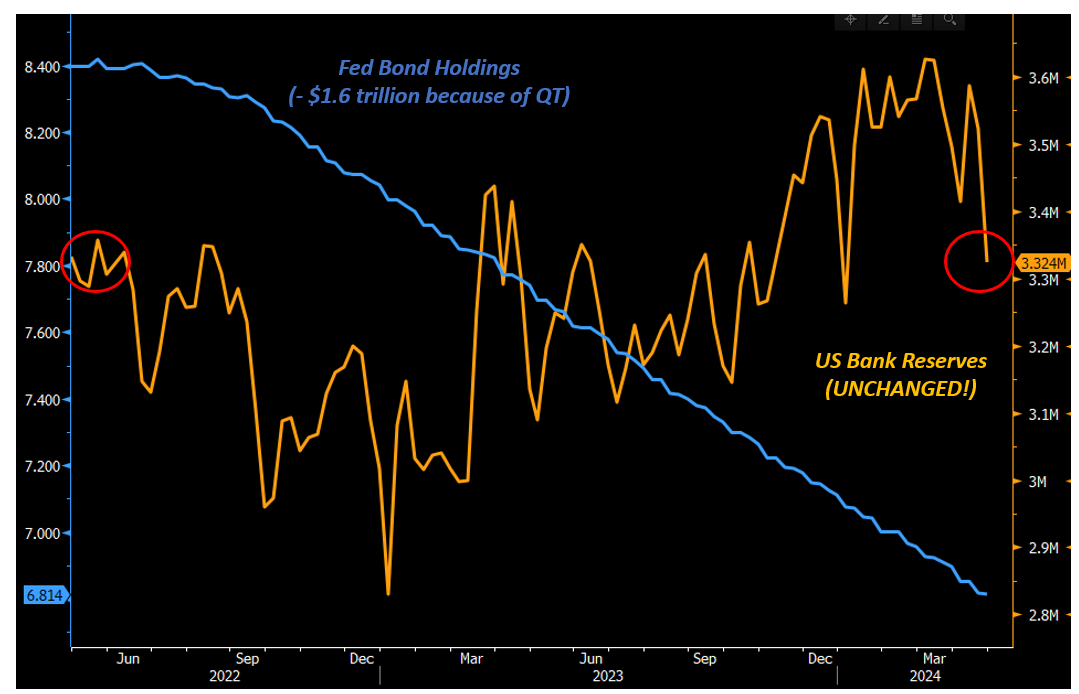

* The Fed’s dovish announcement: a sizeable tapering of their Quantitative…

Published on 1 year, 5 months ago

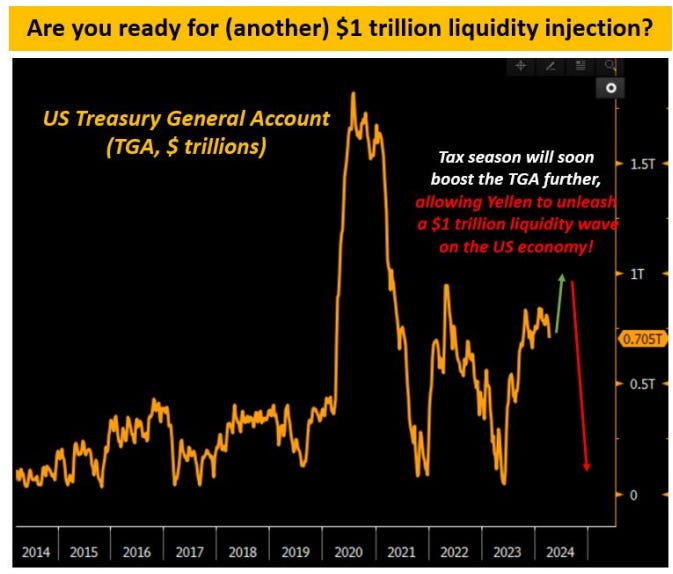

A Trillion (Dollar) Reasons

Here is a trillion (dollar) reasons why the US economy is likely to hold up until elections: between now and then, Yellen is likely to drain the Treasury General Account (TGA) and unleash a wave of a…

Published on 1 year, 5 months ago

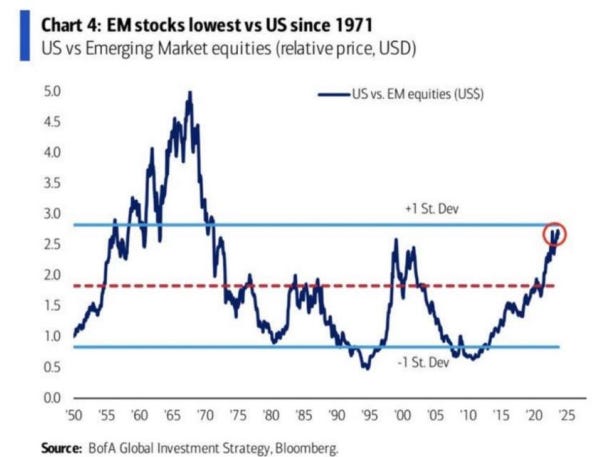

Do You Own These in Your Portfolio?

If you have been around for the last 10 years as a global macro investor you have experienced a situation where the US stock market was pretty much the only game in town. Since 2010 US stock markets …

Published on 1 year, 6 months ago

Beware Animal Spirits

Animal spirits are running loose.

* Bitcoin just hit all-time highs;

* NFTs of penguins and monkeys selling for over $500k;

* Virtually bankrupt stocks like Carvana rallying to the moon;

Investors aren’…

Published on 1 year, 6 months ago

IT'S BACK!

Welcome back to The Macro Compass.

Let me cut to the chase: The Macro Trading Floor is back!

TMTF was one of the most popular macro podcasts out there - I launched it with my friend Andreas Steno in 20…

Published on 1 year, 7 months ago

The Truth About Money

Good Sunday, and welcome back to The Macro Compass.

Macro will dominate the next decade, and plenty of investment opportunities should consequently arise for macro investors.

This is why I am working o…

Published on 1 year, 7 months ago

Bubbles & AntiBubbles

Good Sunday, and welcome back to The Macro Compass!

The window for early investors in my upcoming Macro Fund is still open, and I am glad to report it’s filling up very rapidly - we are at 40%+ of its…

Published on 1 year, 7 months ago

Pay Attention To Monetary Plumbing

Next week is huge: revisions to 2023 CPI, US labor market print, the Fed, and most importantly the Quarterly Refunding Announcement (QRA) everyone talks about.

So I thought I’d share an initial framew…

Published on 1 year, 8 months ago