Episode Details

Back to Episodes

Bezos's inflation idiocy

Description

On Saturday, President Biden demanded on Twitter that Big Oil “bring down the price you are charging at the pump to reflect the cost you’re paying for the product.” This prompted Amazon’s Jeff Bezos, the second richest man in the world, to call Biden’s statement either “straight ahead misdirection or a deep misunderstanding of basic market dynamics.”

That’s rich. Bezos of all people should know that a major reason prices are rising is hugely profitable corporations like his Amazon have been using inflation as cover to raise price even further.

Last year, corporate profits overall reached a 70-year high. In the fourth quarter, Amazon's profit nearly doubled — and it announced it would raise the price of its popular Prime membership.

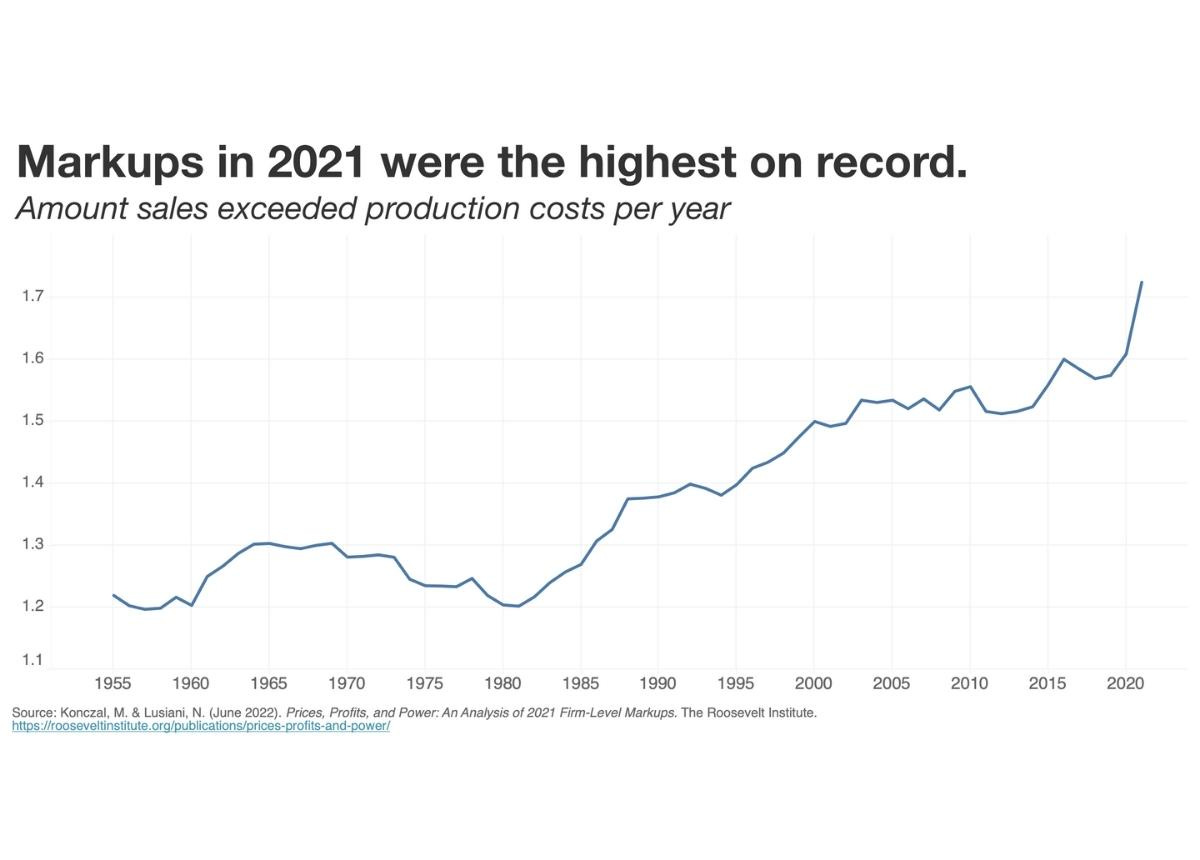

Yes, corporations are facing rising costs for everything from materials to labor. But they’re raising their prices even higher than those costs. In a new paper, researchers Mike Konczal and Niko Lusiani of the Roosevelt Institute find that markups — the difference between what corporations pay for labor and materials and the prices they charge their customers — have been rising dramatically.

They find the same when they compare corporate costs with their sales.

Corporations have been raising their prices because they have market power to do so (two-thirds of all American industries have become more concentrated over the last four decades). And their customers believe the price hikes are justified because the corporations have higher costs.

Let’s be clear. The corporate price hikes have come on top of a worldwide surge in pent-up demand following the worst of the pandemic, global shortages of goods and services seeking to meet that demand, China’s lockdowns, and Putin’s war in Ukraine (which has put upward pressure on energy and food prices).

But the corporate price hikes often exceed these higher costs.

As gas prices at the pump reach their highest point in 14 years, Big Oil is enjoying a gusher. In the first quarter of 2022, Chevron’s profits more than quadrupled from the year before. ExxonMobil’s profits more than doubled. In the past month alone, even though the price of crude oil has fallen approximately $15 a barrel, prices at gas pumps have barely dropped.

Big corporations aren’t pouring these windfall profits back into production. Instead, they’ve embarked on the largest program of stock buybacks in history. ExxonMobil alone plans to buy back $30 billion of stock this year (up from the $10 billion it announced earlier). If it hadn’t been for the buybacks, the stock market would look even worse.

The Fed’s efforts to slow the economy will not remedy these causes of inflation. Hiking interest rates to reduce inflation is like trying to reduce someone’s fever by putting them in a freezer — it doesn’t deal with the cause and may be quite harmful.

Rate hikes increase the costs of borrowing to individuals and consumers, which causes them to cut back on purchases of everything. This, in turn, causes the economy to slow — resulting in higher unemployment. How much higher? Lawrence Summers, Bill Clinton’s Treasury Secretary, says containing inflation will require five years of 6 percent unemployment, or two years of unemployment at 7.5 percent or one year at 10 percent.

The harm inflicted by this alleged cure would be worse than the disease. The first f