Episode Details

Back to Episodes

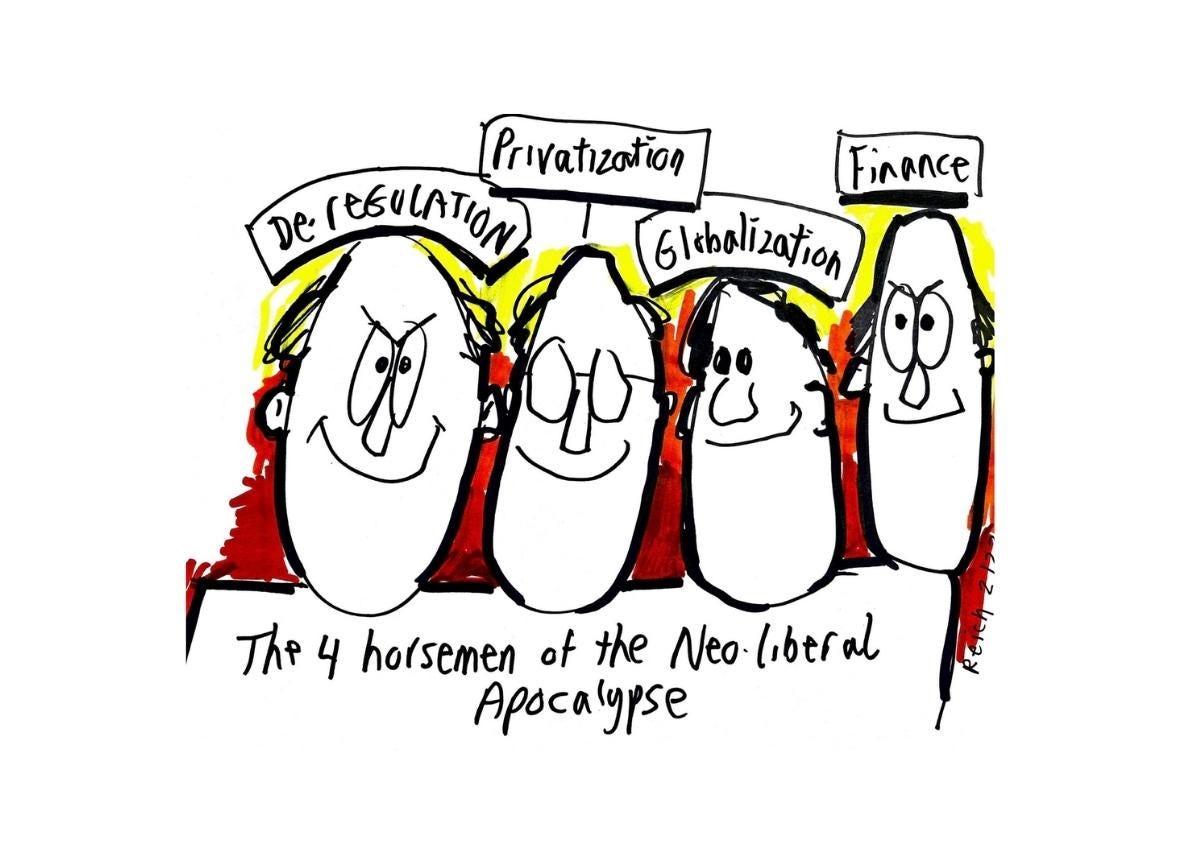

The Week Ahead: The Four Horsemen of the Neoliberal Apocalypse

Description

The biggest stories this week are likely to be the continuing standoff between NATO (led by the United States) and Putin in the Ukraine, the new Russo-Chinese detente, and the Republican Party’s continuing drift toward Trumpism. One way of tying these together to reveal a larger pattern is to talk about the expanded Child Tax Credit. You heard me right. The fate of the expanded Child Tax Credit illustrates a basic problem that runs through all this.

Let me explain.

Even before the pandemic, more than one out of every six America children was impoverished, often without enough food or inadequate shelter. Meanwhile, the typical American family was living precariously from paycheck to paycheck. At the same time, a record high share of national wealth was already surging to the top.

Starting last July, the nation did an experiment that might have limited these extremes. That’s when 36 million American families began receiving monthly payments of up to $3000 per child ($3,600 for each child under 6).

Presto. Child poverty dropped by at least a third, and the typical family gained some breathing space.

It’s rare for a government policy to work so unambiguously well, so quickly, on such a huge scale, and on so basic a problem.

The experiment ended abruptly in December, notwithstanding.

On Dec. 19, as you may recall, Senator Joe Manchin announced he would not vote for President Biden’s Build Back Better Act, which would have continued the monthly payments. He cited concerns over the ballooning federal budget, and offered to support a smaller version without the child subsidy. Not a single Republican senator would vote for it either, citing similar concerns. That, it seems, was the end.

But obviously, the federal budget would not balloon if taxes were raised on the rich and on big corporations to pay for the child subsidy -- at a cost of an estimated $100 billion per year, or $1.6 trillion over ten years.

That’s less than big corporations and the rich will have saved on taxes from the Trump Republican tax cut. Repeal it, and there’d be adequate money.

It’s also less than the increase in the wealth of America’s 745 billionaires since the pandemic began. Why not a wealth tax?

It’s also less than one-seventh of America’s bloated defense budget. Arguably, America would be stronger in future years if fewer American children are impoverished and the typical family more financially secure.

The experiment died because, put simply, big corporations and the super-rich didn’t want to pay for it.

Capitalism and democracy can co-exist as long as democracy is in the driver’s seat -- reducing the inequalities, insecurities, joblessness, and poverty that accompany unbridled profit-seeking.

For the first three decades after World War II, democracy was in the driver’s seat. Both the US and war-ravaged Western Europe built the largest middle classes the world had ever seen, and the largest and most buoyant democracies. The arrangement was far from perfect, but with addition of civil rights and voting rights, subsidized health care (in the US, Medicar