Episode Details

Back to Episodes

Could All Debt Actually Just Be Canceled?

Description

Could a “debt jubilee” happen in the US? Malcolm and Simone dive deep into skyrocketing consumer debt, unsustainable government obligations (like Social Security insolvency by 2032-2034), and historical debt cancellations—from ancient Mesopotamia and Biblical jubilees to Japan’s post-WWII wealth confiscation and modern “Abenomics.”

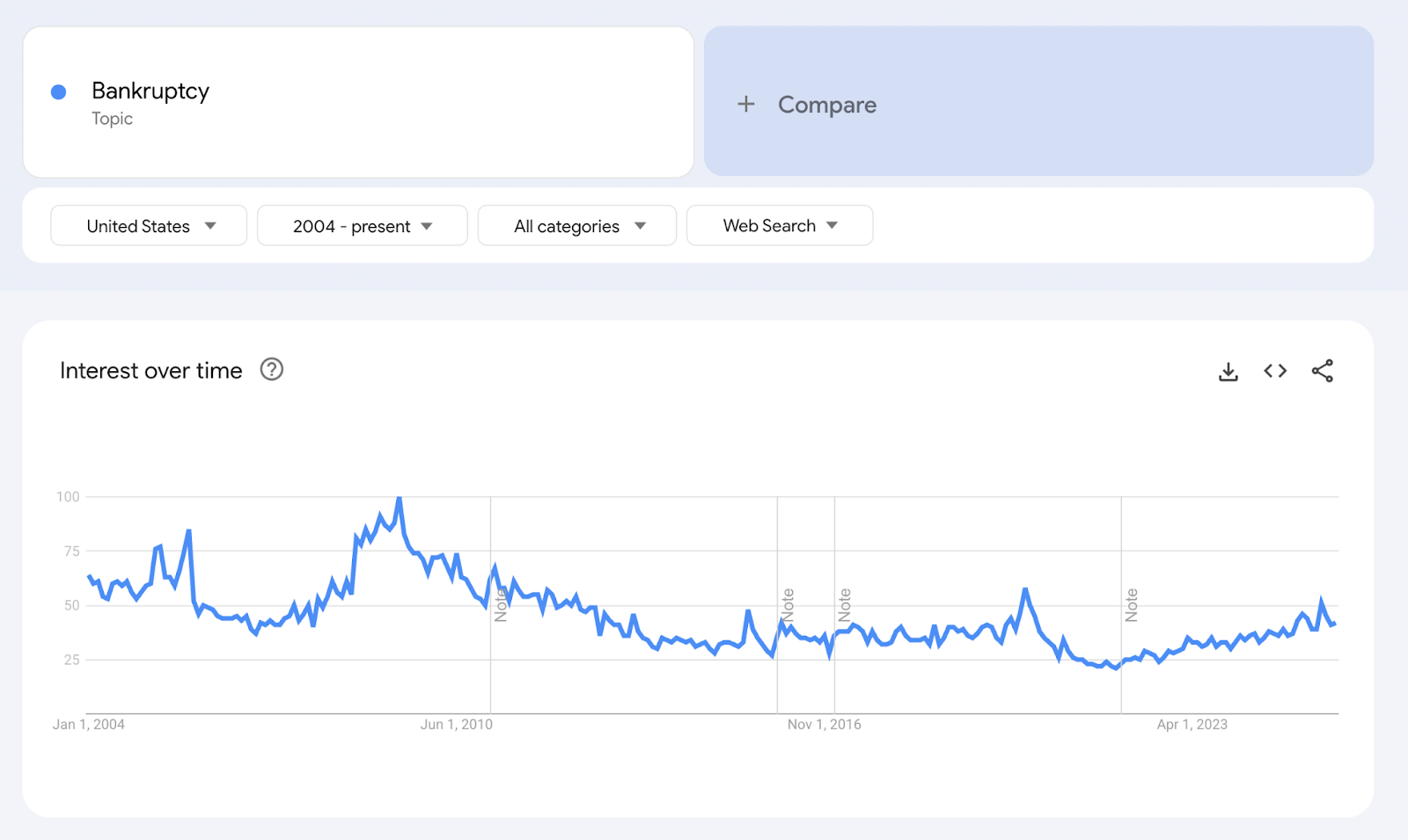

They debate whether America’s record-high credit card debt, buy-now-pay-later defaults, and cultural attitudes toward money could trigger a crisis, hyperinflation, or forced wealth redistribution. Is bankruptcy already America’s soft debt jubilee? What should you invest in (or avoid) if things get weird in the 2030s?

Hilarious tangents include check fraud “hacks,” Caleb Hammer roasts, ramen lifehacks, and why Japan pulled off drastic reforms while Venezuela and Zimbabwe collapsed.

As Simone outlined this episode, the outline (and links) follows! The transcript is at the end of the post. Merry Christmas, you filthy animals!

Episode Outline

* US consumer debt levels are currently at record highs in 2025, both in nominal and inflation-adjusted terms

* Average credit card debt among cardholders with unpaid balances rose to about $7,321 in Q1 2025, up 5.8% from a year earlier

* People are using buy now pay later services like Klarna and Afterpay at record levels and increasingly paying late

* A LendingTree survey found that 41% of BNPL users made a late payment in 2025, up from 34% the prior year

* April 2025, 31% of federal student loan borrowers were 90+ days delinquent on payments,

* This comes at a time when…

* People are beginning to view debt payoff, the concept of capitalism, and even faith in fiat currency with increasing skepticism

* Loan defaults and late payments are on the rise

* democratic socialist political figures like Zohran Mamdani are gaining serious traction and public attention

* Even our governments are spending like someone with zero expectation of paying off their debt

* US social security likely to falter in 2032-2034

* The UK is set to experience a social security crisis in the early 2030s

* And this matters, because something’s gotta give, and in the past, this has involved various forms of debt jubilees

* So we’re going to discuss:

* The situation with consumer debt today

* The situation with government debt today

* How unsustainable debt has been dealt with historically

* How this could go poorly

* How this could go well and how we as individuals might prepare

Banks and Fractional Reserves

* The post:

* Oct 21 trending discussion: https://x.com/i/trending/1980520651816341983

US Consumer Debt

* Credit card balances hit another all-time high, reaching around $1.21 trillion in Q2 2025—matching last year’s record with annualized growth rates of over 9% in mid-2025.

* Credit card interest rates are commonly averaging 22–24% in 2025, compared to around 15% just a few years ago.

* Delinquency rates for credit cards and other non-housing debts have increased to levels well above pre-pandemic norms. In Q2 2025, about 4.4% of all debt was in some phase of delinquency.

* Klarna reported a 17% increase in consumer credit losses in Q1 2025, totaling $136 million, with repayment defaults rising among users.

* Student loan delinquencies are also rising, especially following the resumption of payments after long pandemic-era forbearance, adding further strain to household finances

* In March 2025, just 35% of federal student-loan borrowers had made their most recent payment on time. The rest were at risk of (or already in) serious delinquency or default.

It has actually been worse recently, though:

* US consumer (household) debt has reached nominal record highs in 2025, but when adjusted for economic growth (e.g., as a percentage of GDP), it remains below pre-2008 financial crisis