Podcast Episode Details

Back to Podcast Episodes

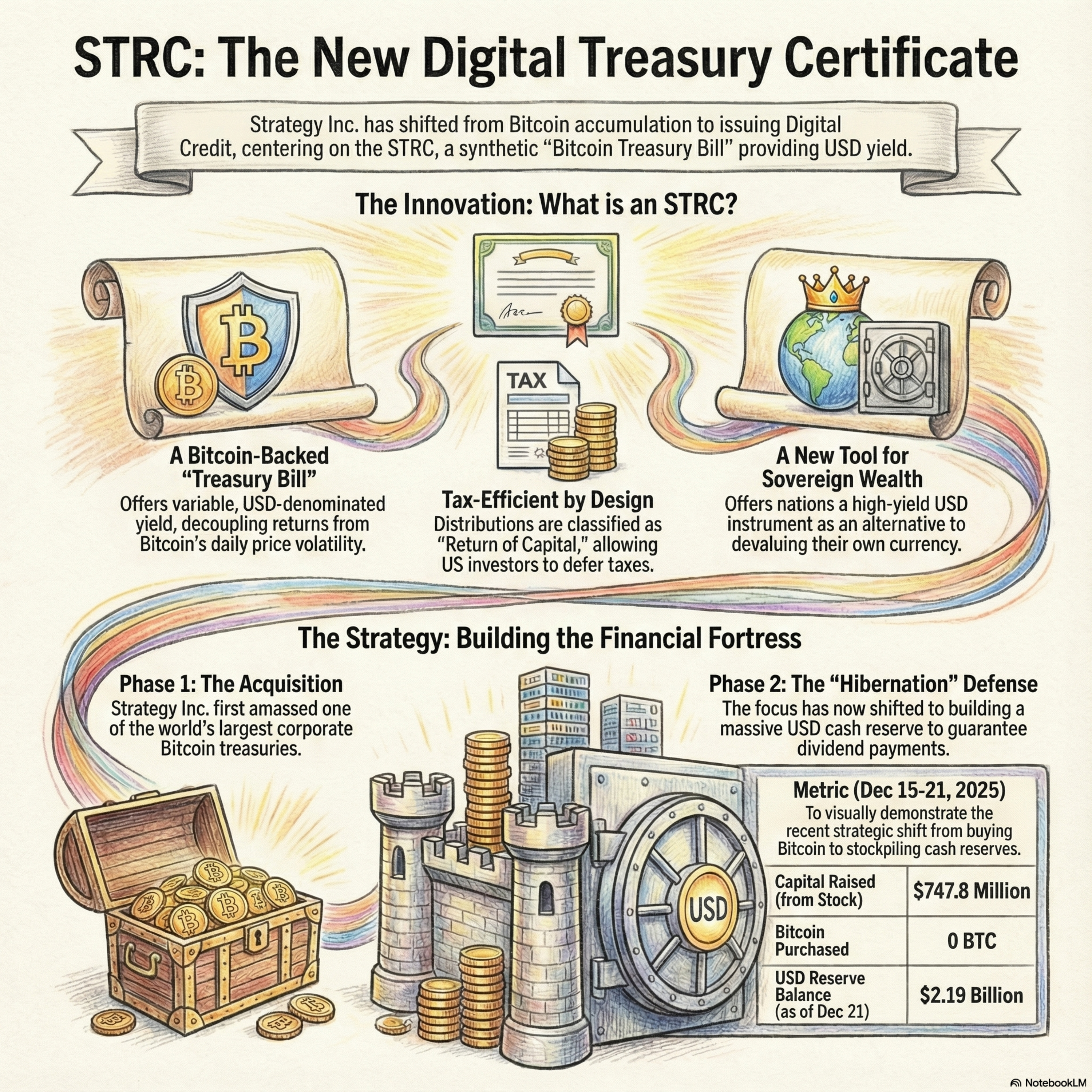

STRC: as Strategy's treasury reserve certificate ! rather than another perpetual preferred !

As of late 2025, Strategy Inc. has successfully transitioned from its origins in enterprise software to become the world's premier issuer of Digital Credit, underpinned by a massive corporate Bitcoin treasury. This evolution reached a critical milestone in December 2025, when the company shifted its operational focus from aggressive Bitcoin acquisition to a defensive "Security Phase." This transition is characterized by the accumulation of a substantial USD liquidity layer intended to protect the company's financial structure from market volatility.A cornerstone of this new financial ecosystem is the STRC (Strategic Treasury Reserve Certificate). Unlike traditional preferred equity, the STRC functions as a synthetic "Bitcoin Treasury Bill." Its most significant innovation is a variable-rate architecture, which allows it to behave like a floating-rate instrument that adjusts to the prevailing cost of capital environment. This makes it the "crown jewel" of Strategy Inc.’s liability curve, appealing to both institutional treasuries and sophisticated retail investors who seek yields backed by hard digital capital rather than static fiat-based returns.The defensive posture adopted in late 2025 is often referred to as the "Hibernation" defense. During a key week in December, the company raised nearly 748 million dollars through its common stock facility while purchasing zero Bitcoin. This capital was instead used to bolster the USD Reserve to approximately 2.19 billion dollars. This reserve acts as a structural guarantee for STRC dividend payments, providing a "3-year hibernation" capability. This ensures that the company can survive a prolonged "crypto winter" without being forced to liquidate its 671,268 Bitcoin holdings, even if the ability to raise new equity becomes restricted due to market conditions.From a tax perspective, STRC offers a significant Return of Capital (ROC) advantage. Because of the company’s unique accounting offsets and its long-term "HODL" strategy, distributions to STRC holders are often classified as a return of capital. This allows US investors to defer taxes on their yields until they sell their positions, effectively enhancing the after-tax growth rate compared to traditional bonds or real estate investment trusts.On the global stage, this model has created a "paradigm shift" for Sovereign Wealth Funds. STRC offers nation-states a way to earn high real yields in a USD-denominated instrument backed by digital assets. By allocating reserves to these certificates, sovereign entities may reduce the pressure to debase their own domestic currencies, using the Strategy Corporate Treasury as an anchor to exit cycles of devaluation.Despite these innovations, Strategy Inc. remains in a state of friction with traditional "Gatekeepers of Wealth." The exclusion of its common stock from the MSCI World Index reflects a structural tension, as legacy financial architects struggle to classify a hybrid model that challenges traditional definitions of productive capital. However, for the company, this exclusion is viewed as a defensive reaction from an establishment disrupted by a new form of Bitcoin-backed corporate credit.#DigitalCredit #STRC #BitcoinTreasury #SecurityPhase #HibernationDefense #SovereignWealth #ROCDividends #FinancialInnovation #MSTR2025

Published on 4 days, 6 hours ago