Episode Details

Back to Episodes

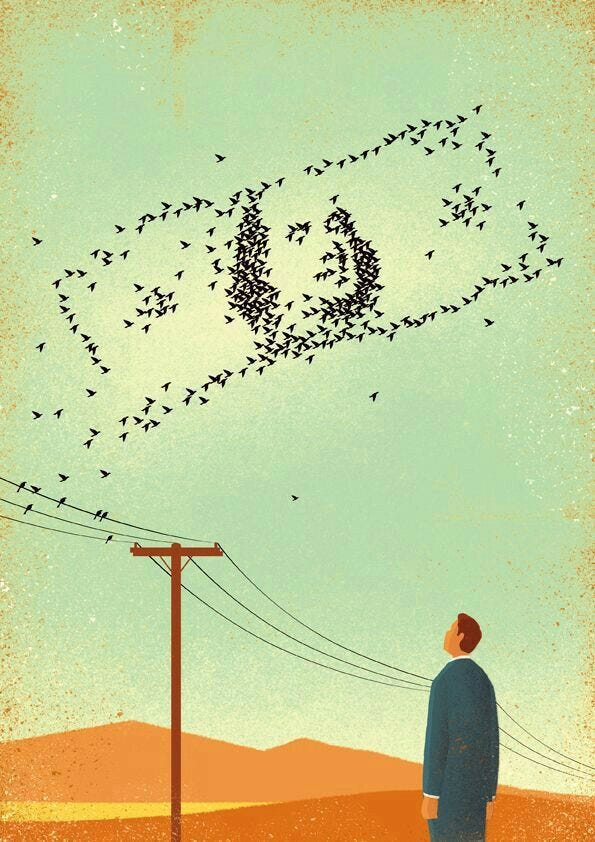

A monetary mirage that visibly reveals the magic trick

Description

Is your value pegged to your priced possessions, your cherished relationships, your status, or simply to your truth? How can you trust yourself to make the right decisions about your time on earth?

Current Experiment: echoing July 1944, when forty four allied nations met in Bretton Woods, New Hampshire, to design a new monetary order that pegged their currencies to the dollar and the dollar to gold.

In my current limited and still studying understanding I am watching two structures being built at the same time and together they change what the dollar feels like in daily life.

What is at stake here is reality. What we think is real is what we believe, so our reality is shaped by our belief system. If our beliefs about money, safety and value are based on mirages, then the choices we make with our savings and our time can take us very far from what we actually need.

let’s dive in, shall we?

On one side stands Tether, it calls itself a stablecoin issuer, yet in practice it behaves like a private central bank for people who cannot touch the United States banking system. It holds a gigantic portfolio of United States Treasury bills, plus physical gold and a large stash of Bitcoin. Its token, USDT, is the way hundreds of millions of people in emerging countries hold and move what they experience as dollars. These are not deposits at a regulated bank inside the United States, they are claims on a company incorporated in the British Virgin Islands that now has deep ties with El Salvador.

“Tether is not a cryptocurrency company. It is a private central bank that has dollarized the developing world without permission.”

Shanaka Anselm Perera

The GENIUS Act has drawn a hard line. One dollar system sits inside the United States where stablecoins must be fully backed by cash and Treasuries and supervised by Washington. An offshore dollar system keeps growing where Tether issues its own version of dollars backed by Treasuries, gold and Bitcoin, supervised by no one in particular. For a huge part of the developing world, the issuer of the everyday dollar is no longer the Federal Reserve, it is another private bank.

For me the mirage is simple; on the screen everything still looks like neutral, safe dollars, underneath those balances are completely different IOUs tied to different balance sheets, different political risks and very different levels of control.

The mirage is the shared belief that all of this belongs to one dollar world. In practice it is a layered structure that uses Bitcoin as collateral, Tether as a private dollar engine and GENIUS compliant stablecoins as a public dollar engine, all plugged into the same mountain of government debt.

Mirage: there is nothing stable in stablecoins

On the other side, the Federal Reserve itself is changing its relationship to the Treasury market in a way that I am still learning to grasp. The headlines say that Quantitative Tightening ended on the first of December and that the balance sheet froze around six point five seven trillion after draining more than two trillion from the financial system.

Under that surface sits the plumbing: A Repo is a secured overnight loan> One party hands over Treasuries and receives cash, then reverses the trade the next day; a reverse repo is the same trade seen from the other side. The cash lender parks its money and holds Treasuries as collateral, repurchase agreements have been part of the Federal Reserve toolkit for more than one century. In the United States they show up around nineteen seventeen as a way for the Fed to lend to banks and they grew into a core Wall Street funding tool in the second half of the twentieth century, which is how they ended up at the heart of today’s money market plumbing scam .

The Ov