Podcast Episode Details

Back to Podcast Episodes

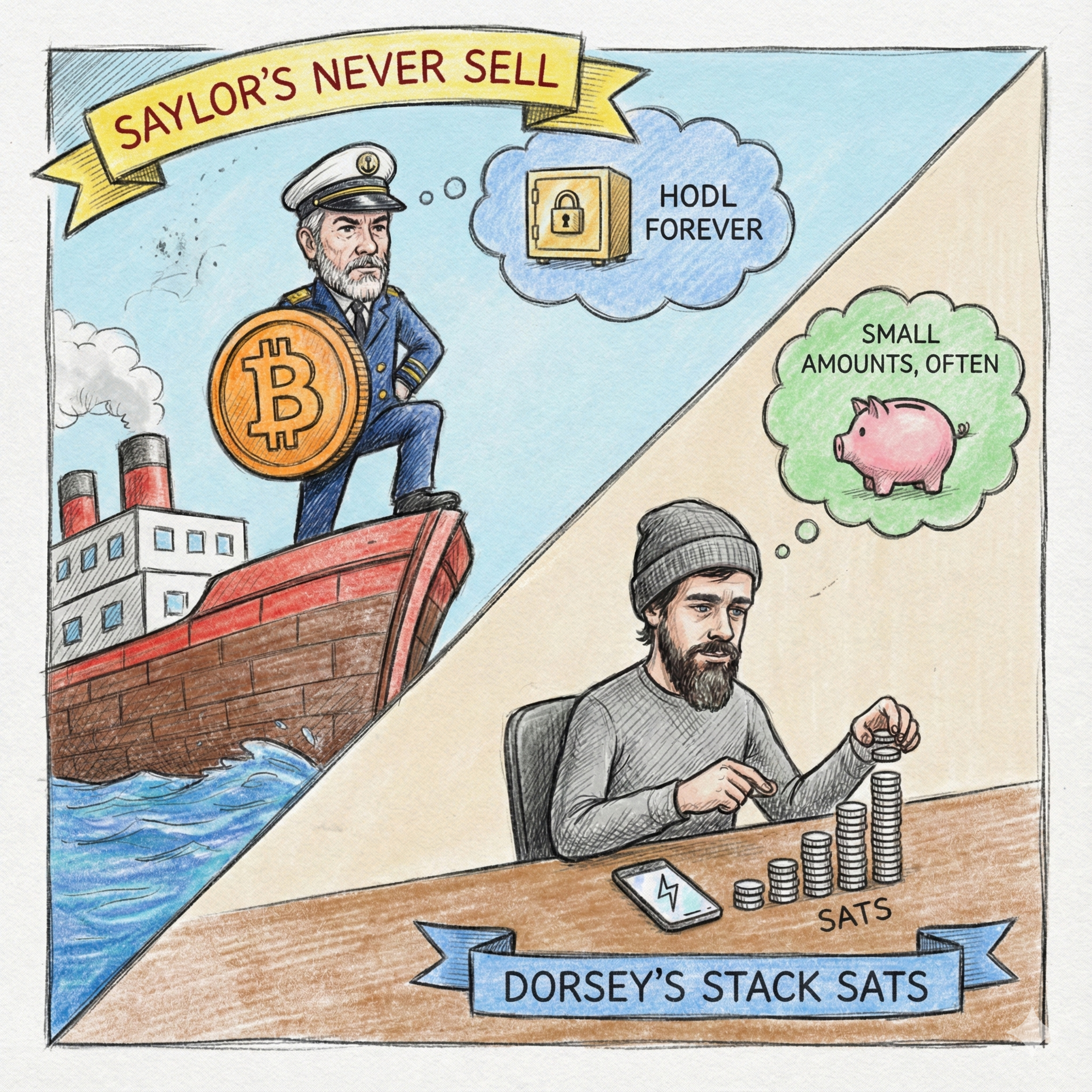

Apex Asset - two sides of same (bit)coin

Bitcoin is increasingly recognized as the Apex Asset, fundamentally shifting its definition from a simple store of value for the wealthy to a crucial tool for survival and access for the world’s poorest and unbanked.

The core argument posits that Bitcoin acts as a bridge, democratizing access to "Asset Economics." Currently, the poor are trapped in "Currency Economics," forced to save in fiat currencies that are mathematically designed to debase through inflation. This continuous devaluation acts as a regressive tax, disproportionately affecting those who hold cash. Meanwhile, the wealthy operate in "Asset Economics," holding appreciating assets like real estate and equities that are insulated from—and often benefit from—inflation.

Bitcoin breaks this structural inequality by providing immediate, permissionless sovereign asset ownership. Unlike traditional high-quality assets, which require high capital minimums, regulatory accreditation, and state-sanctioned identity (KYC), Bitcoin ownership is granted based on mathematics. The network does not know your name; it only knows you possess the private key, making wealth unseizable and portable. This feature is vital for refugees, the undocumented, and the unbanked who are barred from owning assets in legacy systems.

The technology’s extreme divisibility, down to the satoshi (a fraction of a penny), eliminates "unit bias," making micro-savings viable. This means a user in a developing nation can convert daily wages into a hard asset immediately, rather than waiting years to save for a prohibitive down payment. There is practically zero barrier to entry; a user can own a fraction of a penny and participate in the same appreciation mechanics as a billionaire.

Crucially, the Lightning Network makes this system highly efficient. It allows transactions for small amounts—from one dollar to ten dollars—at near-zero acquisition costs, drastically undercutting the 10% to 20% fees charged by traditional remittance services like MoneyGram or Western Union, which typically crush the small savings of the poor.

In practice, many poor users willingly make a custody trade-off, prioritizing convenience, simplicity, and recovery. They see the custodian as a necessary "Help Desk" because they trust a reliable company more than their own ability to manage a private key. However, this introduces Counterparty Risk, including Corporate Risk (funds lost if the company fails) and Government Risk (surveillance or censorship).

To mitigate this centralization trap, a "Third Way" is emerging: Federated Chaumian Mints, or Fedimint. This system functions like a Community Credit Union, where funds are held collectively by a group of local trusted people, or Guardians, using multi-sig technology. Utilizing Blinded eCash, the Guardians can see the total pool but not the individual identity of the owner or the transaction details. This structure provides the convenience and recovery needed by the poor while ensuring cryptographic privacy and censorship resistance. Ultimately, Bitcoin is the ultimate tool for the excluded saver, allowing millions to finally exit the trap of depreciating fiat.

#Bitcoin #ApexAsset #FinancialInclusion #Unbanked #LightningNetwork #Satoshi #Fedimint #AssetEconomics #SovereignOwnership #Crypto #WealthGap #Decentralization

Published on 1 month ago