Podcast Episode Details

Back to Podcast Episodes

The AI Mega Deals Are Here & Stocks Will Keep Going Higher

Today’s letter is brought to you by MoonPay!

Join over 30 million users who trust MoonPay as their universal crypto account.

We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.

MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.

Start now and get zero MoonPay fees1 on your first transaction.

To investors,

The stock market has been on a tear this year. The S&P 500 is up more than 16% and the Nasdaq has surged 23% higher year-to-date. This outperformance is largely attributed to the investment boom related to artificial intelligence.

But one question lingers in the mind of every investor…are we in an AI bubble?

The answer to that question will determine the portfolio returns of tens of millions of people. Before we discuss whether we are in a bubble or not, it is important to understand what is actually happening in the economy.

The best description I have seen comes from Adam Kobeissi when he wrote about the AI construction boom:

“The Dodge Momentum Index surged +60% YoY in September, to the highest on record. This index serves as a leading indicator of non-residential construction, tracking projects that typically move from planning to groundbreaking within 9–12 months.

The jump was led by a +75% YoY spike in institutional projects such as healthcare and public buildings, and a +53% jump in commercial activity driven by data centers and retail. The index also rose +3% MoM in September, extending a powerful uptrend after +5% in August and +21% in July.

In other words, the surge in AI-driven data center projects is set to translate into a powerful construction boom across the US in 2026. AI’s impact on the real economy is accelerating.”

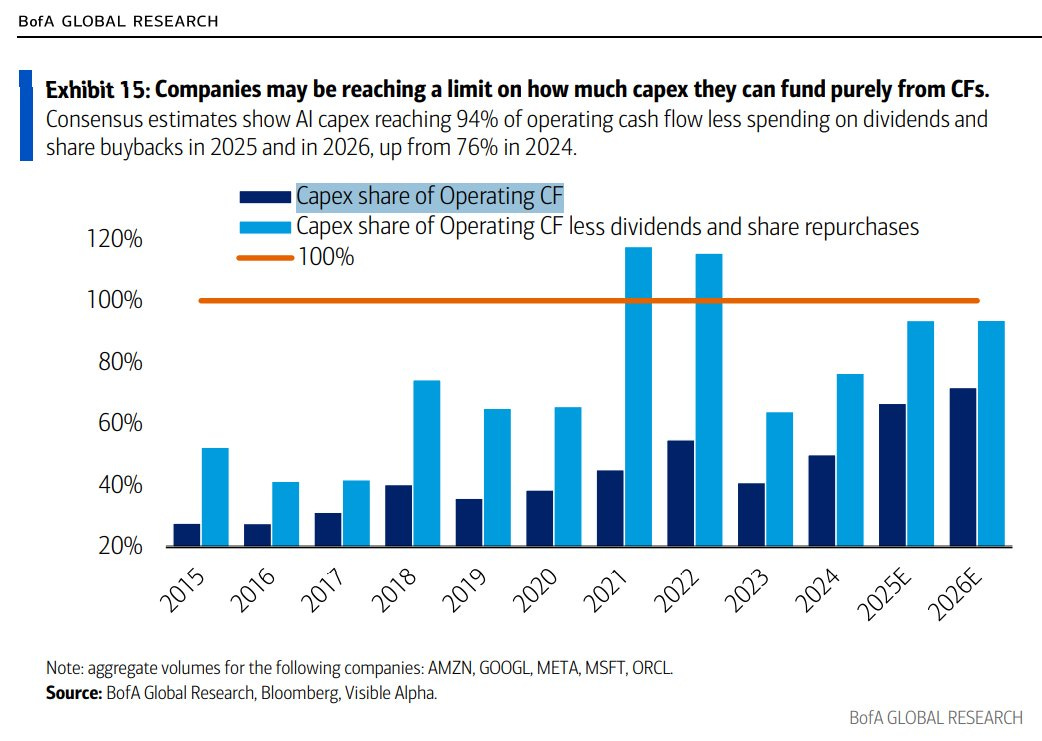

Goldman Sachs and Mike Zaccardi explain a big reason for this explosion is that mega-cap companies continue to exceed expectations on their AI CAPEX spending.

So whether we are in a bubble or not, we know that companies are sinking insane amounts of money into building data centers and power generation. In fact, the investment in power generation is very important to pay attention to because the market is realizing that power, not chips, are the limiting factor for hyperscalers.

Don’t take my word for it though. Here is Microsoft CEO Satya Nadella explaining the lack of power supply on a recent episode of the BG2 podcast:

It is crazy to hear the CEO of a multi-trillion dollar company saying he has the compute capacity, but he doesn’t have the data centers and power supply to plug them into. This completely changes the way that investors will view the AI market.

Strategist Shay Boloor explains:

“The real constraint is not compute but power & data center space. This is exactly why access to powered data centers has become the new leverage point.

Published on 3 days, 11 hours ago