Podcast Episode Details

Back to Podcast Episodes

The People's Voice Was Heard Last Night

Today’s Letter is brought to you by Arch Public!

Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years. The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions. Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence. Talk to us today and discover why our expertise sets us apart.

To Investors,

We saw Democrat candidates win major races yesterday for Governor of Virginia, Governor of New Jersey, and mayor of New York City. This is a good ‘ole fashion ass kicking. A straight rout across the board in favor of the Democrats.

Half of the country is waking up happy this morning and the other half is left wondering how we got to this point. But put politics aside for a second.

There is a very important finance and economics story smacking us in the face. The voice of the people was heard last night. They are clearly telling the world that rent is too high, groceries are too expensive, the system is not working for them, and change is needed.

You can see these problems clearly in the data.

First, the difference in sentiment between the people who make more than $100,000 and those who make less than $100,000 is widening. You can see this clearly getting worse since the summer of 2022 and accelerating in 2025.

You can call it a k-shaped economy. You can call it a bifurcation. No matter what you call it, the economy is being split into two groups: those that own assets and those that don’t.

This k-shaped economy related to sentiment passes through to consumer spending habits. We know that the top 10% of earners account for half of US personal spending.

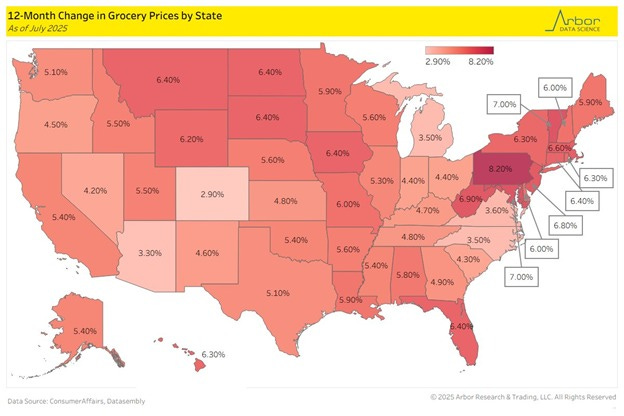

But when you dig into consumer prices of every day items like groceries, you can see a very big problem. Adam Kobeissi writes “US grocery prices have risen +5.3% YoY as of July 2025. To put this differently, if a family spends ~$1,000 a month or $12,000 a year on groceries, this marks an average annual increase of +$636.”

Home affordability doesn’t offer a much different story. Kobeissi continues by showing “it would take a -38% drop in home prices OR a +60% JUMP in household income JUST for affordability to go back to 2019 levels. You must now make ~$113,000/year to afford the MEDIAN home in the US.”

The problem is only going to get worse in the short-term too. For example, artificial intelligence is driving a wedge into the job market. You see the people who are using AI continue to grow revenue and profits, while the working class is watching job openings fall off a cliff as AI begins replacing many jobs.

So the financial answer is for people to acquire assets. Bill D’Alessandro shows this chart of wage growth vs. asset appreciation. He says “you’ve got to be converting your time/wages into assets. Best time to start was 20 years ago, second best time is now.”

So when I think about what is happening here, you have to believe multiple things are true. The people are voicing their opinion for a reason. Affordability in America is way too high. We have to bring that down and prov

Published on 1 day, 10 hours ago