Podcast Episode Details

Back to Podcast Episodes

This Stock Dividend Idea Could Save America

Today’s letter is brought to you by Lava!

Lava’s bitcoin-backed line of credit allows you to unlock your bitcoin’s purchasing power— instantly, flexibly, and securely— without selling your bitcoin.

Borrow dollars in real time with no monthly payments, open terms, and the lowest fixed interest rates in the industry— starting at just 5%.

Lava is the only bitcoin lending platform available globally—you can borrow from any country or state.

With Lava, you can access a full suite of bitcoin-powered financial tools:

* → Borrow dollars instantly

* → Earn 5% APY ****on your USD balance

* → Buy bitcoin with zero fees

It’s everything you need to grow your bitcoin wealth— without ever selling your bitcoin.

To investors,

The US economy is in a very weird position. We are watching companies accelerate their earnings, while the job market is declining at a rapid pace. You will read headlines about how great everything is going followed by headlines about how horrible everything is.

Both perspectives are true. It just depends where you are looking.

Take corporate earnings as a positive example. Creative Planning’s Charlie Bilello writes “with 70% of companies reported, S&P 500 operating earnings are up 19% year-over-year, the 11th straight positive quarter and highest growth rate since Q4 2021.”

Given how well corporations are doing, you would expect investors to be euphoric. Their portfolios are growing in value and stocks keep climbing higher. But in the surprise of the year, investors are incredibly negative right now.

Carson Group’s Ryan Detrick points out investor sentiment currently sits at Extreme Fear even though “a few days ago the S&P 500, Russell 2000, Dow, Nasdaq, and Nasdaq-100 all closed at new monthly all-time highs.”

It is crazy to think about stocks at all-time highs, yet investor sentiment in the toilet. Those are the type of ingredients that almost certainly guarantee we can’t be at a market top.

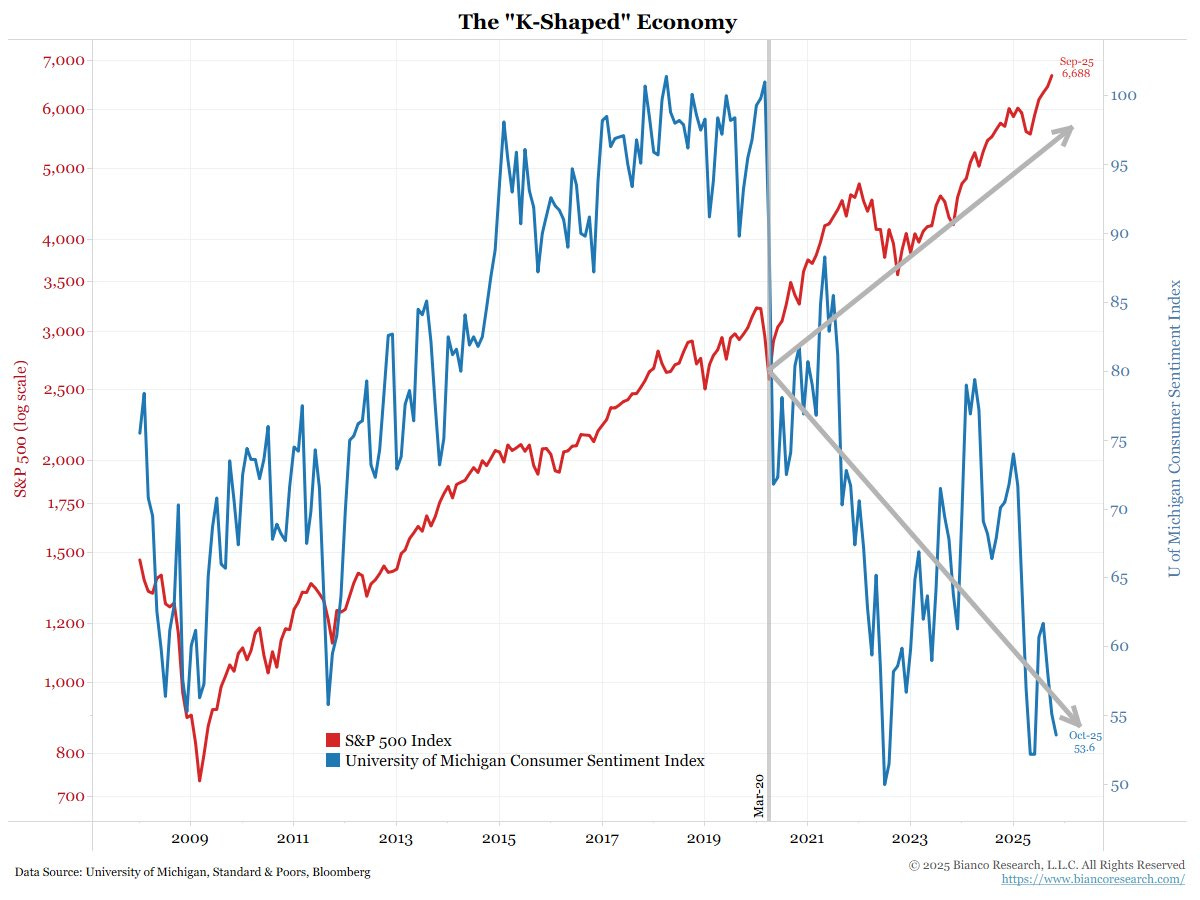

The sentiment divergence is not exclusive to investors either. Jim Bianco shows consumer sentiment is falling rapidly as well. He writes “Red is the stock market. It’s going straight up. Rate cuts help. Blue is consumer sentiment, it’s going straight down and is near a multi decade low. Inflation (affordability) is driving this measure lower. Rate cuts hurt.”

Lets go back to investors for a second though. Ryan Detrick goes on to explain that the market is overwhelmed with bearish investors. They are everywhere. He writes “AAII bulls minus bears is -11.1% in 2025. Only 3 other times has this ever been -10% and all happened in bear markets (1990, 2008, and 2022). Incredibly, bears outnumber bulls by 11.1% in ‘08, the exact same level as in 2025 so far.”

But the dichotomy gets even weirder when you dig deeper into the data. Commerce Secretary Howard Lutnick was asked about the US economy last night in an interview and he said “Which way is the stock market going? Up, up, up! Which way is the economy going? 3.8% last quarter... the economy is on fire because Donald Trump’s economy is one that says... BUILD IN AMERICA.”

Lutnick is not wrong. But contrast that with the jobs

Published on 12 hours ago