Podcast Episode Details

Back to Podcast Episodes

Is The Great Rotation From Gold to Bitcoin Upon Us?

Today’s letter is brought to you by MoonPay + Exodus!

Crypto should be simple, secure, and rewarding. With MoonPay and Exodus, it is.Exodus built one of the most intuitive wallets in the world, and is now a public company on the NYSE whose team is paid entirely in Bitcoin.Experience how easy crypto can be with Exodus and MoonPay. Buy, sell, or stake your favorite assets directly in-app using Apple Pay, PayPal, or your card of choice. No complex exchanges. No long waits. Just instant access to crypto in 180+ countries, powered by MoonPay.Whether you’re stacking sats or exploring new tokens, Exodus gives you the tools to manage it, and MoonPay provides the bridge to get there.

Trade crypto the easy way with MoonPay + Exodus.

To investors,

All eyes are on gold and bitcoin as capital allocators try to figure out what is happening in the world. The narrative coming into 2025 was gold is a great asset, but it does a better job preventing losses in your portfolio than it does driving outperformance. This is where bitcoin came in.

The decentralized asset was pitched as a digital gold, or as I have previously called it “gold with wings.” The idea has been that bitcoin boasts the same sound money principles as the precious metal, but bitcoin’s unique properties (including the finite supply, the bitcoin halving feature, and the relatively young life since inception) should ensure bitcoin would continue outperforming gold.

That hasn’t happened in 2025 though.

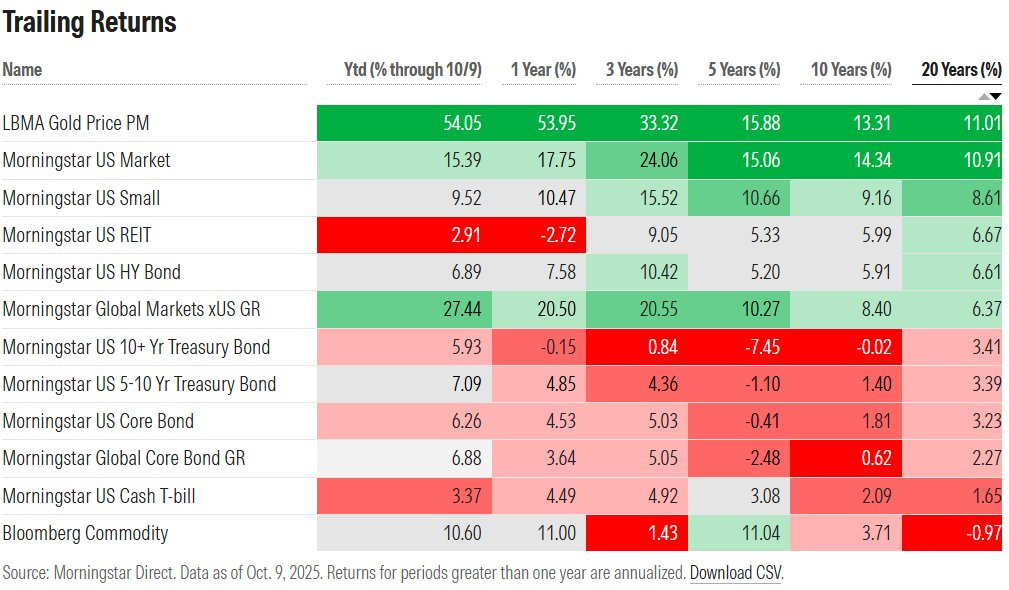

In fact, gold has appreciated about 60% year-to-date, which is the best performance in nearly a half century. Creative Planning’s Charlie Bilello highlights “gold is now the best performing major asset class over the last 20 years with an annualized return of over 11%.”

This performance, particularly the last 11 months, has driven central bank’s allocation to gold significantly higher. Charlie writes “gold now accounts for over 20% of global central bank reserves, the highest share we’ve seen in nearly three decades.”

This central bank demand is important because it overcame the fact that US retail investors have essentially been net sellers of gold and silver since the big rally in price started in March 2024.

But here is the part of the story that is confusing many investors — bitcoin and gold have historically traded in tight correlation. When gold has gone up, bitcoin has followed approximately 100 days later.

These two assets benefit from the same tailwinds of higher national debts, undisciplined monetary policy, and geopolitical uncertainty. In response to these issues, investors prefer to allocate larger percentages of their portfolio to sound money assets. Assets that are outside the legacy system and assets that no one can create more of.

So why is gold responding to the recent global developments, but bitco

Published on 2 weeks, 3 days ago