Podcast Episode Details

Back to Podcast Episodes

The National Debt Just Hit A New Record High And Our Children Will Pay The Bill

Today’s Letter is brought to you by Arch Public!

Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.Talk to us today and discover why our expertise sets us apart.

To investors,

The United States of America is the first to do a lot of things. We were the first to write and ratify a Constitution. We were first to put a human in space. We were the first to land on the moon. We were the first to create a commercial nuclear power plant. We were the first to ratify important amendments on human rights like free speech and due process.

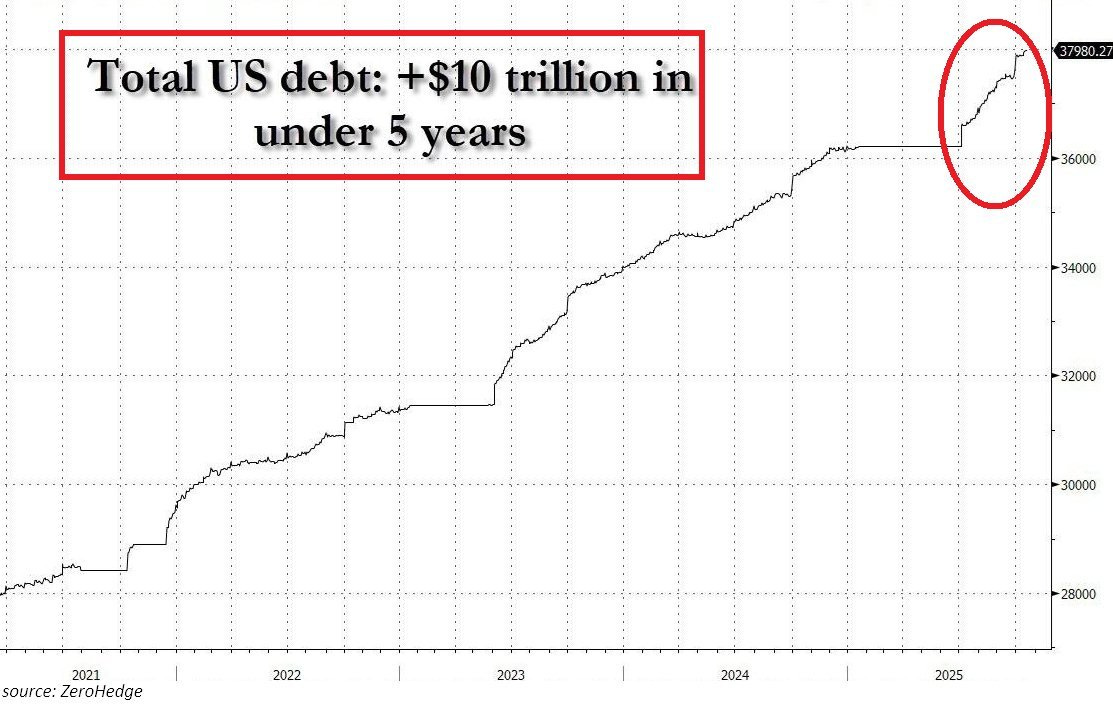

And this week America added a new “first” to our resume. The US national debt just crossed $38 trillion, which makes us the first country in human history to have accumulated this much debt.

Adam Kobeissi writes “Total US debt officially crosses above $38 trillion for the first time in history. This marks a +$500 BILLION jump this month, or +$23 billion per day.”

Give yourself a round of applause everyone.

Oh wait, this isn’t a milestone we should be celebrating. In fact, we should be appalled that our country’s leadership has lacked the financial discipline to avoid this scenario.

A big driver of the catastrophic destiny we have been pre-ordained to is our addiction to money printing. Jesse Myers writes “The money printer hasn’t run this hot since COVID. Global M2 money supply now ~$137 trillion. It was $129 trillion just 6 months ago.”

Lawrence Lepard points out “12% annualized growth rate in global M2. Far cry from the Fed’s 2% target and they haven’t really even turned on the printer yet.”

I don’t see the national debt problem going away in my lifetime. This means the currency will be debased to avoid default, so our politicians on both sides of the aisle are essentially sticking our children with the bill.

It is a horrible, no good situation. The only thing I know to do is opt-out of the broken system with some portion of my economic value. The higher the national debt goes, the higher bitcoin will go. And it doesn’t appear either of them will stop any time soon.

Hope everyone has a great day. I’ll talk to you tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why The Bitcoin Bull Market Is Not Over With Jeff Park

Jeff Park is a Partner and Chief Investment Officer at ProCap BTC. In this episode, we unpack why Bitcoin isn’t the bubble — it’s the pin.

Jeff breaks down the rotation from gold into Bitcoin, how whales are contributing spot BTC to ETFs, and what Coinbase’s acquisition of Echo signals for both retail and institutional investors.

Enjoy!

Podcast Sponsors

* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out F

Published on 2 weeks ago