Podcast Episode Details

Back to Podcast Episodes

China Trade Deal And Rate Cuts Will Send Markets Higher

You’re invited to ResiDay 2025, a conference for today’s top leaders in residential real estate.

Join myself and ResiClub Founder Lance Lambert on Friday, November 7th in New York City for a one-day conference bringing together the housing market’s top investors, developers, builders, lenders, and brokers. Expect top-tier speakers, networking with industry leaders, and data-driven conversation around the next decade of housing.

Speakers highlights include…

* Bill Pulte, Director, FHFA (Virtual)

* Sean Dobson, Founder & CEO, Amherst

* Jim Jacobi, President, Parkland Communities

* Kaz Nejatian, CEO, OpenDoor (Virtual)

* Raunaq Singh, Founder & CEO, Roam

* Allan Merrill, Chairman & CEO, Beazer Homes

* John Rogers, Chief Data & Analytics Officer, Cotality

Tickets are limited, secure your spot here: https://luma.com/ResiDay2025

To investors,

Asset prices love responding to market catalysts. Sometimes catalysts are telegraphed and other times they come as a surprise. Take the Federal Reserve’s planned meeting on Tuesday and Wednesday this week.

Every investor knows it is coming. It has been marked on calendars all year. Most investors expect the central bank to cut interest rates. In fact, Polymarket is currently showing a 98% chance of a 25 basis point cut.

Asset prices like cheaper capital because investors push further out on the risk curve. Lower rates signal a continued tailwind for stocks and bitcoin. And it is not just the Federal Reserve’s monetary policy decisions that matter in this regard.

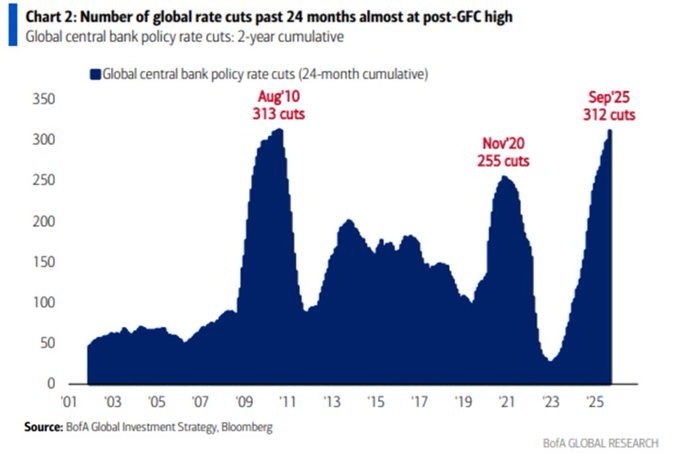

Bitwise’s André Dragosch writes “the number of global rate cuts [in the] past 24 months is already higher than after Covid but bears still think bitcoin has already peaked.”

It is crazy to see 312 interest rate cuts around the world over the last 24 months when you realize the Fed’s interest rate is still set at 4% or higher. There is a lot of room to go for America’s central bank to bring rates back down to 1-2%.

But the interest rate cuts this week are only part of the story. Everyone knows those cuts are coming, but what we didn’t know until this weekend was how likely a US-China trade deal was.

Treasury Secretary Scott Bessent did the media rounds Sunday morning and wanted to make sure the world knew a trade deal is coming. Bloomberg writes:

“Top trade negotiators for the US and China said they came to terms on a range of contentious points, setting the table for leaders Donald Trump and Xi Jinping to finalize a deal and ease trade tensions that have rattled global markets.

After two days of talks in Malaysia wrapped up Sunday, a Chinese official said the two sides reached a preliminary consensus on topics including export controls, fentanyl and shipping levies.

US Treasury Secretary Scott Bessent, speaking later in an interview with CBS News, said Trump’s threat of 100% tariffs on Chinese goods “is effectively off the table” and he expected the Asian nation to make “substantial” soybean purchases as well as offer a deferral on sweeping rare earth controls. The US wouldn’t change its export controls directed at China, he added.”

So what should we expect to happen if the US-China trade deal gets announced? Jordi Visser explains how bullish it should be for stocks and bitcoin:

Investors like certainty. They want predictability. If they get clarity

Published on 1 week, 3 days ago