Podcast Episode Details

Back to Podcast Episodes

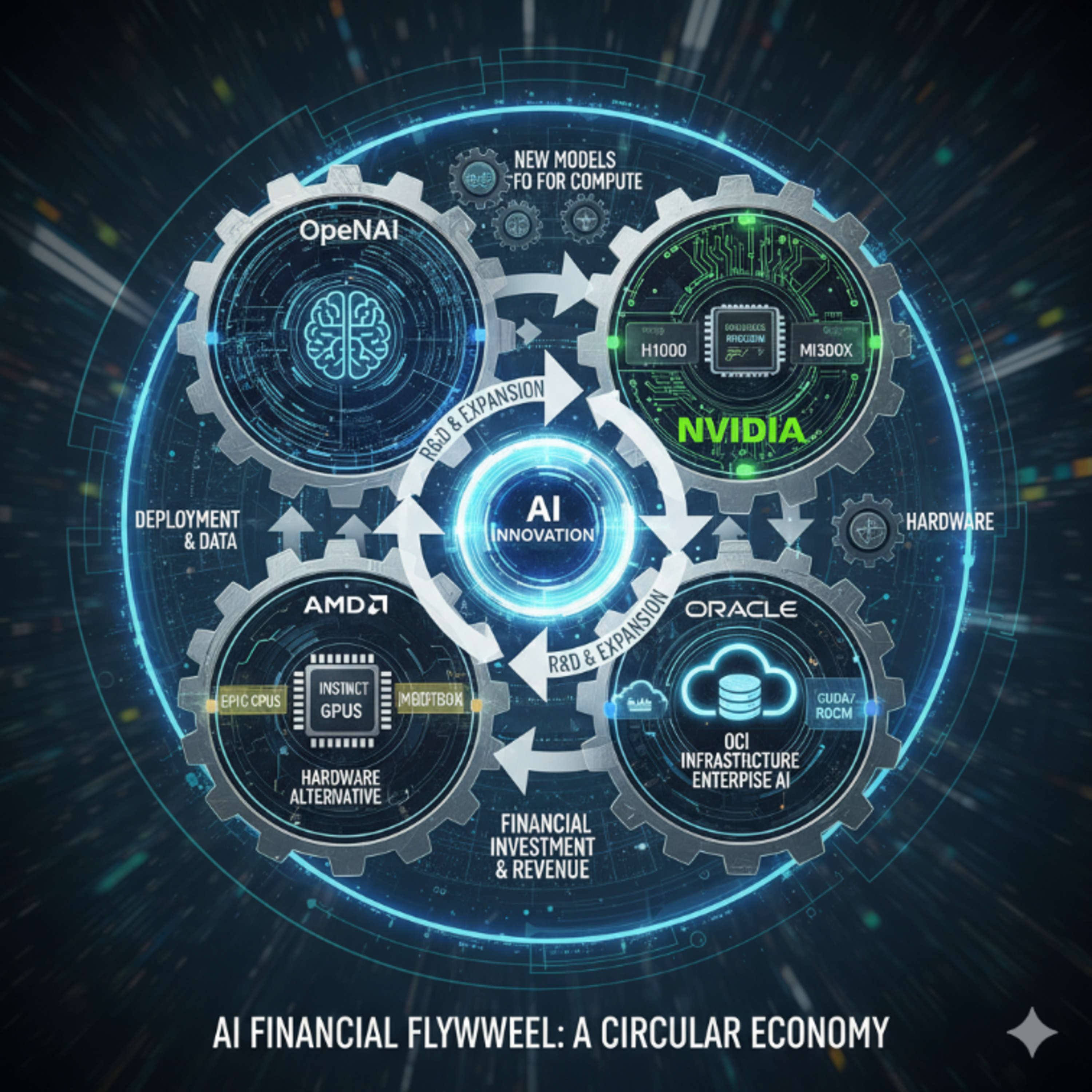

AI flywheel or Financial Engineering ? - openAI, nVidia , Oracle and AMD

https://g.co/gemini/share/f6ffdd487615

AI Financial flywheel: openAI , nVidia , Oracle , AMD circular economy!

The artificial intelligence industry, spearheaded by OpenAI, is undergoing a profound structural transformation, architecting an unprecedented economic model defined by a self-reinforcing loop of circular capital. A series of landmark, multi-hundred-billion-dollar infrastructure agreements has revealed a new paradigm where primary technology suppliers are becoming the primary financiers of their largest customers. This capital is then immediately recycled back into the ecosystem through the procurement of essential computing resources, creating a powerful flywheel of engineered growth and market consolidation. Commitments of staggering scale—including NVIDIA's potential $100 billion investment in OpenAI, AMD's strategic equity offering, and Oracle's historic $300 billion cloud contract—are not merely transactions but the foundational pillars of this new industrial logic.

This report will provide a forensic deconstruction of the financial architecture and strategic calculus behind OpenAI's pivotal deals with NVIDIA, AMD, and Oracle. It will then dissect the mechanics of the emerging "circular revenue" model, examining its implications for market valuation, competitive dynamics, and systemic financial risk. The findings indicate that the AI capital flywheel is a potent tool for market acceleration, but its long-term sustainability is contingent on the industry's ability to generate profits that can justify the massive capital outlays. The strategic imperative for industry leaders and investors is to navigate the complexities of this new financial engine to identify durable value and manage the inherent risks.

Published on 2 months, 3 weeks ago