Podcast Episode Details

Back to Podcast Episodes

Run It Cold Now, Run It Hot Later

Hi everyone - this is Alf, the CIO of my macro hedge fund Palinuro Capital.I hope you’re having a great day.

Before we start, do you want to be on the distribution list of my macro hedge fund?

Every two weeks, you will receive an update on the macro themes we are watching and the track record at Palinuro Capital.

If you are a hedge fund allocator and you want to be added to the distribution list, click on the link below:

Add me to the distribution list for Alf’s macro hedge fund Palinuro Capital

And now, to today’s macro research piece.

My macro models have been suggesting a bi-modal framework to approach markets for the near future: Run It Cold Now (growth < expectations, and dovish Fed) and Run It Hot Later (growth up, inflation risk premia up, but no Fed hawkishness).

My Run It Cold Now theory has been increasingly vindicated by labor market data, and markets are often busy trading what’s in front of them rather than looking through a potential reacceleration in 2026.

This is why it’s vital to figure out:

1. How early/late do we sit within the ‘’Run It Cold Now’’ period;

2. How much has the market priced in by now;

3. Consequently: is it still worth getting engaged in Run It Cold trades, or shall we look at Run It Hot Later ideas already?

As a reminder, my macro models suggest tariffs will act as a fiscal tightening mechanism until year-end.

By early 2026, the OBBB fiscal impulse will offset and Trump’s new initiatives alongside lowered Fed Funds and private money creation should propel a Run It Hot Later period.

First, some evidence that US labor demand is really weak: extrapolating benchmark revisions from April 2025 onwards, the US has been consistently shedding jobs!

To get a broader perspective on the labor market we can rely on unrevised data which incorporates demand and supply for labor: for example, unemployment rate and its important subcomponents.

The chart below shows the number of long-term (27+ weeks) unemployed Americans as a percentage of the total labor force. At 1.14%, this number is already as high as in 2002 or summer 2008 – in both cases, a recession was already visibly hitting America:

Why is US labor demand so weak?

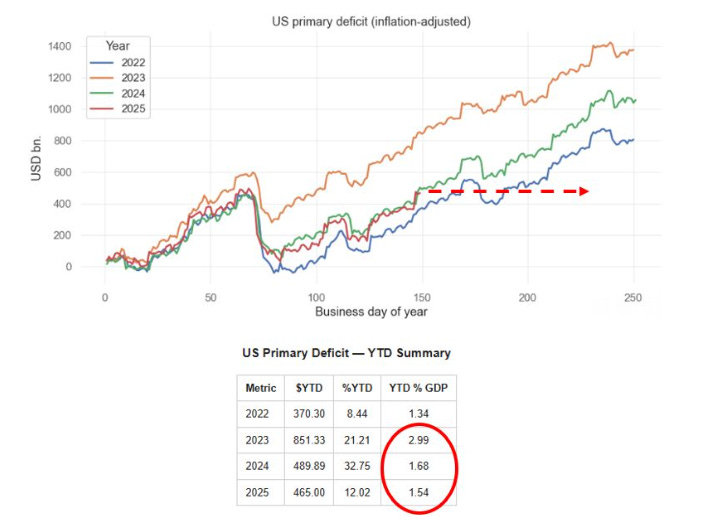

Due to tariffs, the US is going through a slowdown of its primary fiscal impulse: the 2025 primary fiscal deficit sits almost 20 bps below last year and markedly below the 2023 pace.

Tariffs are effectively acting as a tax on US companies and consumers:

This seems to be confirmed by ‘’the best economist Druckenmiller knows’‘: the internals of the stock market.

The chart below shows (in white) the ratio between an index of the 5 largest US payroll processors companies and the equal-weight SPX, plotted against 2-year Treasury yields (in green).

If there are no new jobs, the largest payroll processors companies in the US will suffer - and indeed, their stocks are trading very weak.

This is an example of how the internals of the stock market suggest the US labor market is very weak, and that the Fed will be soon called to ease more:

The US economy is ‘‘running cold’’ now, yet stock markets are roaring and risk sentiment remains very aggressive - why?

The private sector money printer is going BRRRR, led by AI.

The chart below shows the big-tech announced capex spending as a % of their EBITDA – it’s already over 65% on average, exceeding the AT&T spending of 1998. To keep up this pace next year, companies will have to resort to debt-funded AI capex:

AI Capex mechanically adds to US GDP even before we get to talk about the ROI.

But the biggest issue with AI Capex is that it doesn’t really

Published on 11 hours ago