Podcast Episode Details

Back to Podcast Episodes

Did The Federal Reserve Abandon Their 2% Inflation Target?

Join us at the Independent Investor Summit in NYC on September 12th!

Markets are breaking records. Public equities are outperforming. And individual investors are driving it all. It’s officially the rise of the retail investor.

On September 12th in NYC, I’m hosting the Independent Investor Summit — a one-day event built exclusively for self-directed investors.

We’re bringing together some of the smartest public market investors I know for a full day of macro insights, market predictions, and one-on-one fireside chats. Speakers include Darius Dale, Jordi Visser, Jeff Park, Chris Camillo, Tom Sosnoff, Jon & Pete Najarian…plus more to be announced.

Pomp Letter subscribers can use code POMPLETTER50 for 50% off GA tickets if you register here by August 8th. See you all there.

To investors,

We had a good old-fashioned internet debate on our hands after Jerome Powell’s press conference on Friday. The drama started with a summary of the Fed’s position from Bloomberg. The article read:

“Powell said the Fed has adopted a new framework that removes a reference to the central bank seeking inflation that averages 2% over time and one to it making decisions on employment based on shortfalls from its maximum level.”

First of all, that sentence is a mouthful. It takes an Einstein-level genius to understand what is being said, right? Not really. You could just read the words and believe them.

But it seems many people had a hard time doing that though. This is where the big controversy comes in. Each X account that shared the summary from Bloomberg was immediately met by a smattering of nerds who claimed the summary was wrong.

They said the Fed wasn’t abandoning the 2% inflation target that has been the bedrock of monetary policy for the last few decades. But the detractors were lost in the sauce and completely denying reality.

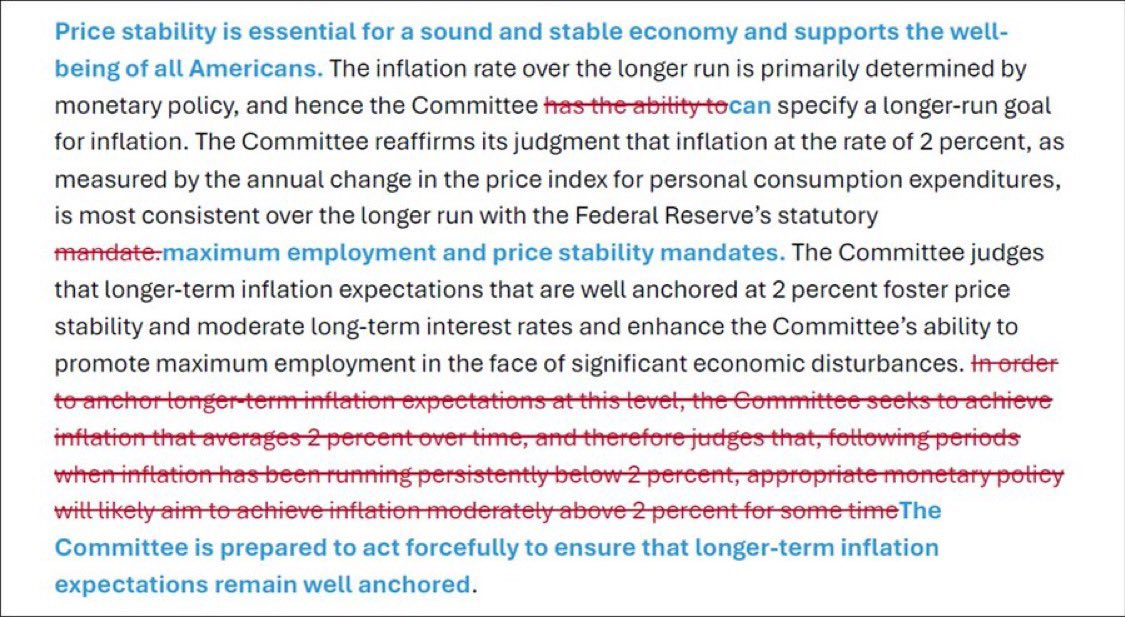

Bloomberg tracks the changes to various Fed policies and statements. In those tracked changes, you can see the Fed removing the sentence that says “the Committee seeks to achieve inflation that averages 2% over time” and replacing it with a sentence that says “the Committee is prepared to act forcefully to ensure that longer-term inflation expectations remain well anchored.”

So as the famous phrase goes, who you going to believe…me or your own eyes?

If people don’t want to acknowledge reality when presented with the source material of changes to Fed policy, no one is going to be able to help them. It doesn’t change the fact that the Federal Reserve finally waived the white flag on Friday.

We know the Fed has previously given up on the 2% inflation target in practice. They haven’t seen inflation at 2% since February 2021. That is more than 50 months without the Fed achieving their “goal” of 2% inflation. That is such a long time that it is obvious they aren’t even trying anymore, regardless of what they kept saying at press conferences.

But now we are seeing the Fed actually SAY something different too. Ben Hunt, who is someone I have long disagreed with about bitcoin, explained it well

Published on 12 hours ago