Podcast Episode Details

Back to Podcast Episodes

Is The Bitcoin Bull Market Over?

Today’s Letter Is Brought To You By A Golden Visa for the Bitcoin-Forward Investor!

Bitizenship helps Bitcoiners secure EU residency and a path to Portuguese citizenship, without abandoning their long-term thesis.

Bitizenship Helps You:✔ Unlock visa-free travel across Europe✔ Secure residency with minimal physical presence✔ Maintain Bitcoin exposure through a regulated structure✔ Set up a future-proof Plan B for your family✔ Gain one of the world’s strongest passports in 5 years

Time-Sensitive Update: Portugal may pass new citizenship rules within the near future, doubling the timeline to 10 years.

Lucky for you, there’s time to lock in the current law if you act now.

To investors,

Capital allocators have attention spans of ants and now they seem to have short-term amnesia as well. In recent days, bitcoin has fallen from the latest all-time high of $124,000, which has sparked a debate on whether the bitcoin cycle is over.

Does it matter that bitcoin is up 20% year-to-date or up nearly 2x in the last year? Nope, of course not. The media and market commentators are busy injecting fear and uncertainty into the market. They want to know if the pullback signals the end of this cycle. They say maybe the bitcoin hype was unsubstantiated. Maybe the bitcoin bears were right that the digital currency could never fulfill its promise.

This is all noise.

The data is overwhelming — the bitcoin bull market is not over yet. Let’s start with the 30 Bitcoin Bull Market Peak Indicators from CoinGlass. We have not hit a single one of them yet. Zero for Thirty.

It is hard for the bull market to be over if we haven’t hit any of the market peak indicators.

We also know that bitcoin tends to cool off in late August and all of September in bull markets. Investor Yannick Maurer writes “In each of the 2013, 2017 and 2021 bull market years, July, August, September and October were green, green, red and green respectively. The same is likely to occur this year. We might see a pullback in September followed by a final 20-30% of gains in October and into early November.”

And if you are merely focused on the short-term, analyst Frank Fetter points out that bitcoin appears to be oversold at the moment according to the Relative Strength Index.

So the recent drawdown in price is likely part of the normal volatility in bitcoin bull markets. We used to get multiple 30% drawdowns in a bull market, now we tend to only get one or two of the large drawdowns. Instead, we continue to see 5-15% drops in price which are healthy. They help to clear out leverage and allow the asset to set itself for the next leg higher in price.

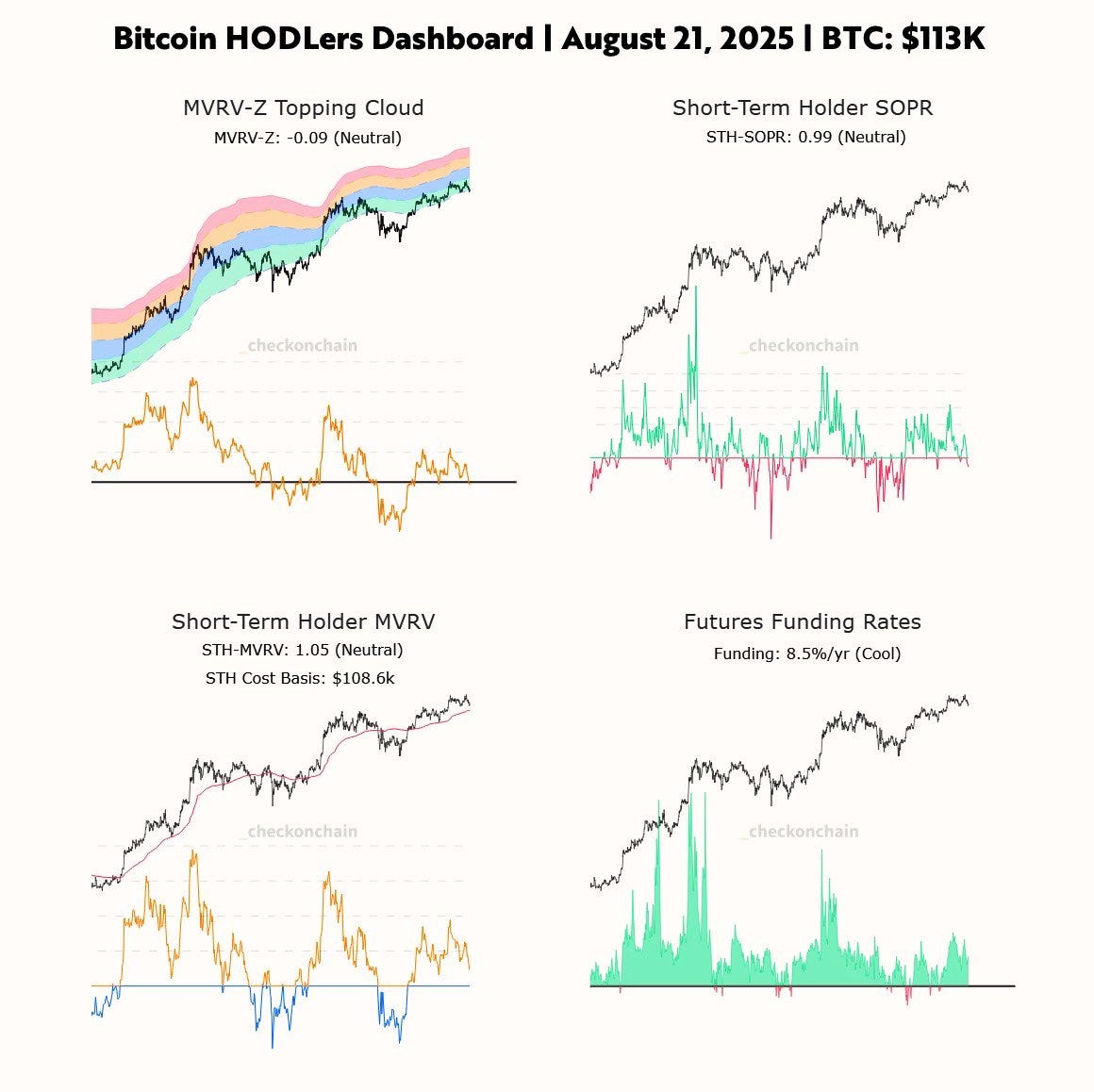

You can see this reset clearly in this dashboard assembled by Frank Fetter. All four metrics are either neutral to cool, which means the market is still in great shape for continued appreciation in price through the coming months.

And here is a crazy stat from Fidelity’s Chris Kuiper. He writes “A significant shift happened in Bitcoin’s ecosystem post-2024 halving: For the first time, the amount of BTC held for 10+ years (ancient supply) is growing faster than new coins are mined. An average of 566 BTC per day are moving into this long-term category, compared to 450 new BTC issued daily. This signals strong conviction from these long-term ho

Published on 4 days, 12 hours ago