Podcast Episode Details

Back to Podcast Episodes

Everything Is Speculation and Everything Is A Meme

To investors,

The government is never going to stop printing money. That is my main investment thesis for the foreseeable future.

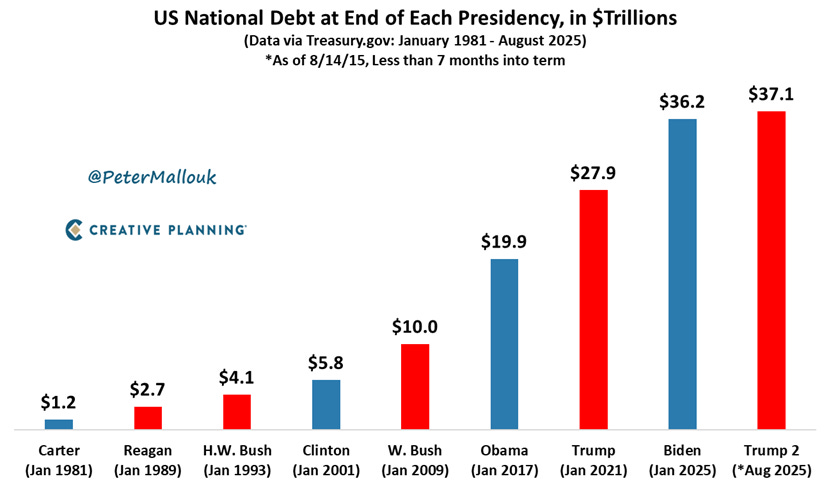

Plenty of people want to politicize our addiction to money printing. They claim the opposing political party is responsible for the undisciplined destruction of our currency. But the truth is money printing isn’t reserved to a specific political party.

Creative Planning’s Peter Mallouk writes “Red or Blue, the national debt goes up. The only thing both parties can agree on is sending the bill to future generations. Next stop: $38 trillion.”

This level of government spending has created one of the fastest debasements of the US dollar in recent memory. Truflation tells us the dollar has lost 28% of its purchasing power since 2020. That is just insane over a half-decade.

This accelerated debasement is driving what Will Manidis calls “casino culture.” He writes:

“Sports betting, shitcoins, meme stocks, vibe coding 100 million in six hours, etc are all expressions of the same deep cultural rot. If youth don’t believe there’s legitimate ways to get rich through work, all of culture will become a rotten sports book for the soul. A decent way to think about where things are headed is all aspects of human life being turned into lotteries. You do whatever minimal labor you can (often demeaning), tithe your wage into the system, and occasionally someone hits it big publicly enough for you to believe.”

Maybe Will is right, maybe he isn’t. But it is clear that sports gambling, altcoins, and mass speculation have become a large part of young people’s culture. I just don’t know how much more prevalent it is today compared to generations in the past.

I remember spending inordinate amounts of time playing poker with my friends in high school. We gambled on fantasy football or weekend sports games. And our friend group’s choice of speculative work in college was the latest multi-level marketing scheme being popularized.

So this brings me to the idea of meme stocks. On one hand, meme stocks exist, but not in the way you think. Most people point to Gamestop and others as examples of the meme stock craze. However, I would point at Berkshire Hathaway as the boomer meme stock. The second Warren Buffett announced his retirement, the stock has fallen approximately 10%. The meme is dying and shareholders are re-valuing the company without the Buffett premium aka the Buffett meme.

You may not like that Berkshire Hathaway is a boomer meme stock, but it absolutely is. Buffett’s disciples will spend thousands of dollars per year to participate in capitalism’s trip to Mecca (Omaha!) for the Berkshire annual meeting. These meme investors will parrot the Buffett talking points like they are spreading the gospel of Jesus Christ.

Doesn’t mean Berkshire is a good or bad investment. Just means that it is the boomer meme stock.

So if Berkshire is a meme stock, then every stock is a meme stock to a degree. Tesla, Palantir, Amazon, Meta, Walmart, or Proctor and Gamble. They all have a narrative that people buy into and are willing to defend. Memes are the message. Anyone denying this modern truth is ill-prepared to allocate capital in today’s dynamic environment.

But there is another argument, which says that if every stock is a meme stock, then no stock is a meme stock. They are all just companies with revenue, expenses, profits, and losses. They either convince the market the future is bright or they are left to die because the market believes the best days are in the rearview mirror.

I personally believe everything is speculation. Buying the S&P 500 is speculative. Buying bitcoin is speculative. Buying commercial real estate or a primary residential home are both speculat

Published on 6 days, 12 hours ago