Podcast Episode Details

Back to Podcast Episodes

Plumbing Risks Ahead

Hi everyone - this is Alf, the CIO of my macro hedge fund Palinuro Capital. I hope you're having a great day.

If you invest in hedge funds or you’re involved in the HF industry: do you want to be on the distribution list of my macro hedge fund? Every two weeks, you will receive an update on the macro themes we are watching and the track record at Palinuro Capital.

To be added to the distribution list, click on the link below:

Add me to the distribution list for Alf's macro hedge fund Palinuro Capital

And now, to today's macro research piece.

The US economy and markets might face a double negative whammy over the next 2 months: a large reduction of the fiscal impulse and the aggressive rebuild of the Treasury General Account (TGA).

A slowdown in real-economy money creation (primary deficits) could result in an economic slowdown, which will coincide with a drainage of bank reserves (TGA buildup) from markets.

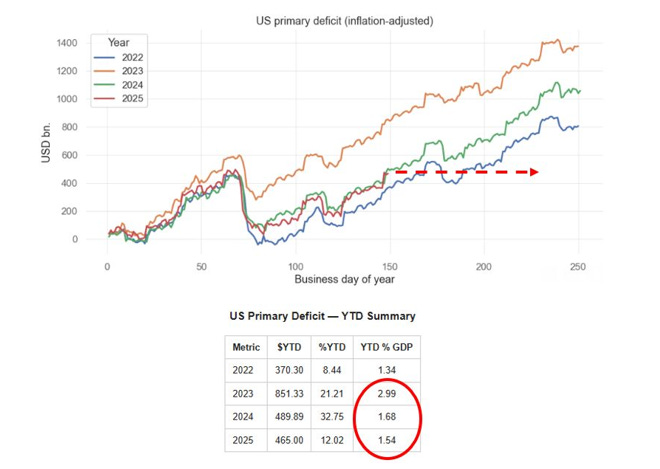

Our US primary deficit tracker stands at 1.54% of GDP as per last week, already lagging behind the 2024 pace and way behind the 2023 staggering pace.

Tariffs came in at almost $30bn in July, and were this pace to continue we’d effectively face an additional $150bn of fiscal drag until the end of the year.

That alone means the US primary deficit might shrink by 15% from $1 trillion in 2024 to $850 billion in 2025:

As a reminder, primary deficit spending = money being injected in the real economy.

Literally, we are talking about money printing.

As step 1 the US government spends money (e.g. cuts taxes) which increases the bank account of households which receive an injection of net worth – they pay less taxes, hence their bank accounts are fatter. Bank deposits grow at commercial banks, which as a result see their reserves at the Fed grow too.

Step 2 describes the bond issuance pattern: the US government issues bonds to ‘’fund’’ deficits, and banks swap reserves for bonds at auctions.

This slide comes from my Monetary Mechanics course, in which I cover all the plumbing topics and variations you can ever imagine – take a look here if interested:

So the private sector will receive a smaller injection of wealth from the US government going forward.

Money creation will still happen, but at a reduced pace – but how should we think about the TGA rebuild?

When the government wants to rebuild its Treasury General Account, it issues bonds but not for the purpose of ‘’financing’’ money creation – rather simply to rebuild its coffers at the Fed (TGA).

As you can see from the T-Accounts at page 2, a TGA rebuild ends up with a reduction in bank reserves (steps 2 and 3) and no creation of money for the private sector.

TGA rebuilds are not uncommon, but as we sit at $421 billion now and the Treasury targets $850 billion by the end of September, the $400bn+ increase in 8 weeks would be one of the most aggressive TGA rebuilds over the last 10 years:

Bank reserves are currently sitting at $3.3 trillion, and given the ongoing QT and large TGA rebuild they could drop below $3 trillion soon. That would be the equivalent of less than 10% of nominal GDP:

The last time we experimented with bank reserves below 10% of nominal GDP was in 2018-2019, and this eventually led to pressures in the repo market in September 2019.

This excellent speech from Waller encapsulates how the Fed thinks about an adequate level of reserves.

A scarce level of bank reserves means US b

Published on 1 month, 3 weeks ago