Podcast Episode Details

Back to Podcast Episodes

Bitcoin Rate of Return

To investors,

There are a few different ways you can measure the results of an investment. You can use Internal Rate of Return (IRR), Return on Investment (ROI), Compound Annual Growth Rate (CAGR), or Time-Weighted and Money-Weighted Returns (TWR/MWR).

Each of these metrics is trying to measure something slightly different, but ultimately the goal is for the calculation to answer the question “is this investment good or bad?”

But there is one problem with these metrics — they all measure the investment return against the US dollar. Why is that a problem? Well, the dollar is being debased at an accelerated rate, so most assets priced in dollars continue to trend higher simply because of the loss of purchasing power.

According to Truflation, the US dollar has lost 28% of its purchasing power since January 2020. That is insane debasement in about half a decade.

So how can you measure the success of an investment while removing the impact of dollar debasement? One way to do it would be to measure the success of an investment against a finite asset that can not be debased or printed.

We can call this a “Bitcoin Rate of Return.”

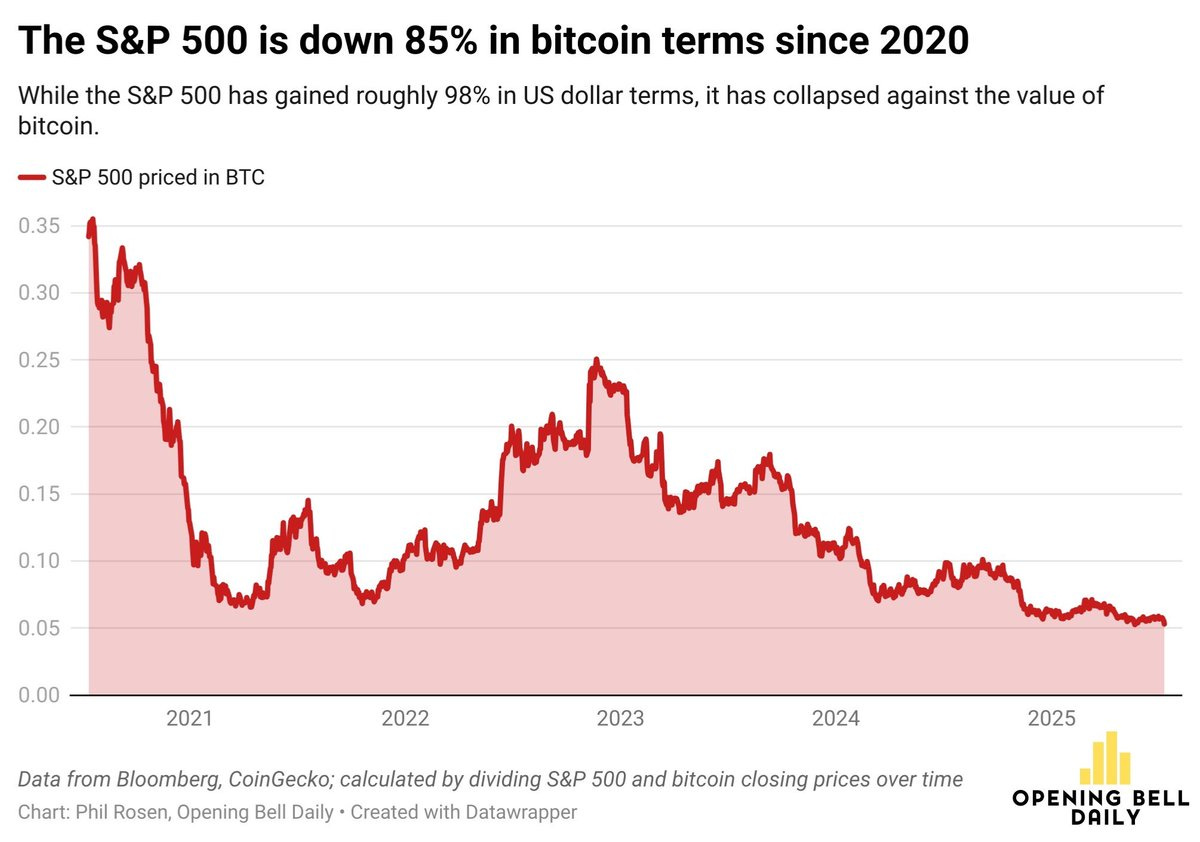

If we apply the concept to the S&P 500, we get a very interesting story. In dollar terms, the S&P 500 has appreciated approximately 100% since 2020.

But if we measure the S&P 500’s success against bitcoin instead of the US dollar, we can see that the S&P is down 85% since 2020 in bitcoin terms. That is a complete destruction of stock portfolios when measured against a finite asset.

You can see the same phenomenon at play with US housing. The median US home has appreciated by about 50% since 2016 when measured in dollar terms. But the same median home has dropped 99% when priced in bitcoin. The home cost about 664 bitcoin in 2016 and now it cost less than 6 bitcoin. I explain this issue here:

So if you were measuring the appreciation of your home, which is a very large portion of many people’s net worth, then you thought you were getting wealthier in dollar terms, but you were actually getting poorer in terms of a finite asset.

These examples are a big reason why I believe “Bitcoin Rate of Return” will become an important new metric in traditional finance.

In fact, I believe this concept is so important that we have decided to change the ticker symbol for our bitcoin-native financial services company, which will be called ProCap Financial after our proposed public market business combination, to BRR.

Here is what we wrote in a recent press release about the ticker symbol change:

“BRR stands for “Bitcoin Rate of Return,” a concept that ProCap BTC believes will emerge as a defining performance metric in the next era of finance. As traditional currencies face ongoing debasement, ProCap BTC advocates for a shift in perspective to evaluating returns not in nominal U.S. dollars, but in Bitcoin, as one of the world’s most sound and scarce monetary assets.

Upon completion of the proposed Business Combination, the goal of the go-forward public company, ProCap Financial Inc. (“ProCap Financial”), is to outperform Bitcoin by accretively acquiring more Bitcoin to grow ProCap Financial’s Bitcoin-per-share. In addition, ProCap Financial’s long-term ambition is to evolve into a full-spectrum Bitcoin-native financial institution where every dollar raised, deployed, or borrowed ultimately compounds back into more Bitcoin per share through differentiated yield-generating strategies and operating cash flows that will support the Bitcoin network and its ecosystem partners.

Given ProCap Financial’s planned strategic focus on generating a compelling Bitcoin rate of return, the transition to the ticker symbol BRR serves as a clear reflection of its long-term vision and alignment with its core objective.”

You can read the Published on 3 weeks, 4 days ago