Podcast Episode Details

Back to Podcast Episodes

On The US Downgrade

Hi everyone - this is Alf, the CIO of my macro hedge fund Palinuro Capital.I hope you're having a great day.

In January the dream of launching my own macro hedge fund became reality.And I have to thank this beautiful TMC Substack community for it.

If you invest in hedge funds or you’re involved in the HF industry: do you want to be on the distribution list of my macro hedge fund?

Every two weeks, you will receive an update on the macro themes we are watching and the track record at Palinuro Capital.

To be added to the distribution list, click on the link below:

Add me to the distribution list for Alf's macro hedge fund Palinuro Capital

And now, to today's macro research piece.

On Friday, the credit agency Moody’s downgraded the US rating by one notch to Aa1 (equivalent to AA+).

By now, you’ve probably read tens of opinion pieces arguing this is the beginning of the end, and that there will be dire consequences for the US Treasury market.

In this piece, you’re going to read a more sober and data-driven approach to this downgrade.

The first thing to understand is why Moody’s downgraded the US: ‘’ Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest cost’’.

The mainstream take here is that this makes sense because the US will never be able to repay its debt and because interest costs have now exceeded $1 trillion per year.

Once you understand the monetary system, both these assertions don’t make any sense:

Any government doing deficit spending and issuing bonds in its own currency (like the US) is not walking into an abyss of doom – it’s just choosing to stimulate the economy by printing money for the private sector.

It doesn’t have to repay anything – if it tries that via budget surpluses it will cause the opposite effect and end up hurting the private sector (via higher taxes).

The process of fiscal deficits creating money for the private sector is explained in the T-Account chart.

Step 1 is the government blowing a hole in its balance sheet to print money for the private sector (aka deficits), which adds net worth for households and corporates which see their net bank deposits increase. These deposits end up at banks, which in turn also see their assets (reserves) increase.

Banks will then swap these reserves for bonds at auctions where the US governments funds its deficits via issuing bonds and primary dealers (banks) plus foreign investors show up to buy bonds – step 2.

Ok fine, ‘’US debt levels are too high now’’ is a groundless worry touted by rating agencies and mainstream commentators but surely paying $1+ trillion in interest costs must be a scary proposition?

Not really: for every $ the US pays for interest on debt, there is an investor making $ on risk-free interest rates she is collecting by owning Treasury bonds.

Repeating this concept is useful to demystify the monetary system: yes, government debt and US interest payments are rising but it’s not like the US needs to ‘’choose’’ between spending on interest and spending money for healthcare – the government balance sheet doesn’t work like ours.

The real limitation to uncontrolled deficit spending is inflation and scarcity of resources (2021-2022 prime example) and not some budget constraints typical of a household.

Ok, but how does the Fitch downgrade affect investors and market participants?

The key point is that US Treasuries are now rated AA+ instead of AAA.

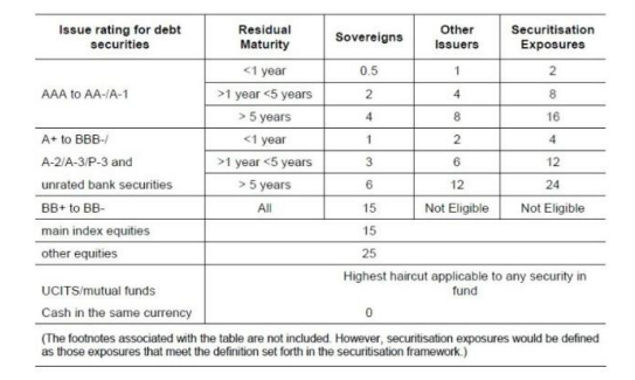

US Treasuries are the most widely used form of collateral in the world due to their high rating, liq

Published on 4 months, 2 weeks ago