Podcast Episode Details

Back to Podcast Episodes

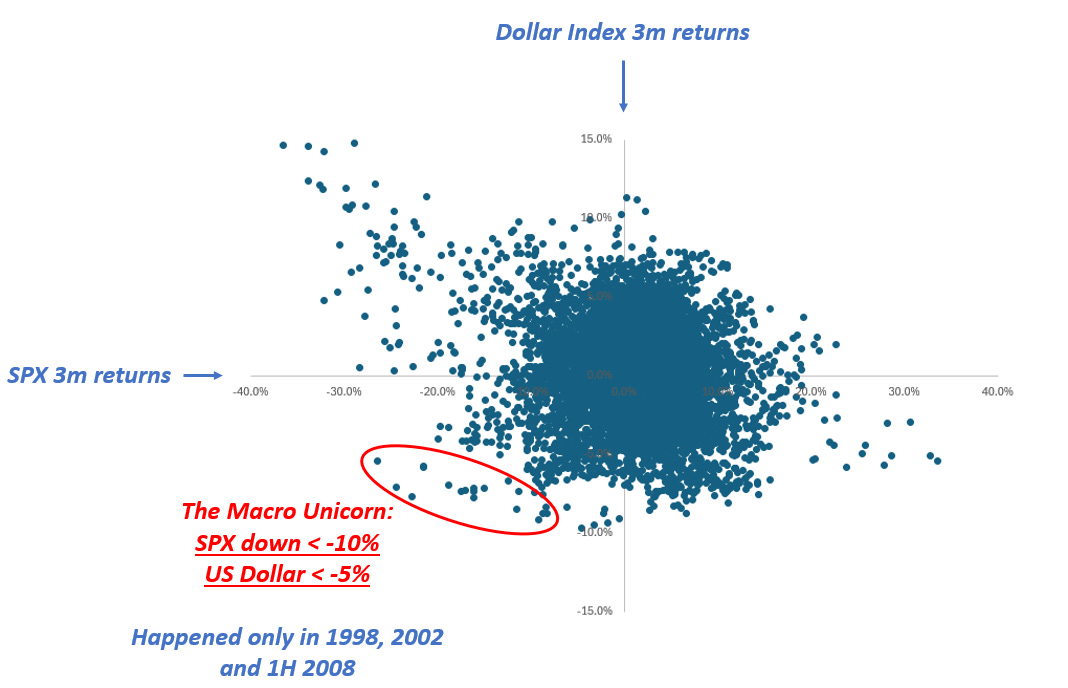

The Macro Unicorn

Hi everyone - this is Alf, the CIO of my macro hedge fund Palinuro Capital. I hope you're having a great day.

Before we start, do you want to be on the distribution list of my macro hedge fund?

Every two weeks, you will receive an update on the macro themes we are watching and the track record at Palinuro Capital.

To be added to the distribution list, click on the link below:

Add me to the distribution list for Alf's macro hedge fund Palinuro Capital

And now, to today's macro research piece.

‘’There are decades where nothing happens; and there are weeks where decades happen’’ – Vladimir Lenin.

Markets were sleepwalking into April 2nd before we had a decent sell-off in US stock markets on Friday.

But the size of the YTD sell-off (a mere 5%) masks a very interesting pattern happening below the surface.

For the first time since the first half of 2008, we are observing a rare macro pattern – almost a unicorn.

The S&P 500 and the US Dollar are going down at the same time:

The chart at page 1 shows the 3-month rolling returns for the US Dollar Index (DXY) and the S&P 500.

Historically, large SPX drawdown (left part of the scatter) tend to see the USD rallying heavily: the most convex USD appreciation (upper side of scatter) tends to coincide with bad equity drawdowns.

This also implies that the upper-left quadrant (SPX down a lot, USD up a lot) experiences the most elongated tail of all the quadrants.

The ‘’Macro Unicorn’’ bottom-left quadrant with SPX drawdowns happening alongside a weak USD is not very populated. It’s crucial to remember the last Macro Unicorn dot goes back to July 2008.

Why was it so hard for the USD to weaken while the S&P 500 was going down?

This is because of three reasons:

1) After 2008, the Eurodollar system blew up in size and never looked back;

2) The US aggressively swallowed global trade surpluses, and in exchange became the epicenter of all global financial flows into Treasuries and US stock markets;

3) Policymakers applied growth-friendly disinflationary policies and politicians postured towards defending Pax Americana on the geopolitical front

With such a combination of factors, the USD tends to appreciate during risk-off events.

A portion of the 12+ trillion dollars of USD debt issued by foreign entities has to be refinanced in any given year, and a risk-off environment which threatens to slow down global trade means all foreign entities rush to buy USDs to service their debt.

Foreign investors buy Treasuries because the Fed has your back and it will cut rates if financial conditions materially worsen – cross-border buying of US Treasuries strengthens the USD as money flows in the US.

The same foreign investors are reluctant to wind down their US equity exposures because Fed cuts will ultimately restore confidence.

Net-net, the USD goes up in risk-off events.

The only periods when the USD weakened alongside the SPX were 1998, 2002 and H1 2008.

These are all periods where US bubbles ended up deflating rapidly: think of the Dot Com bubble burst in 2001 or the US housing market crash of H1 2008 – before it turned into a global financial crisis.

These episodes all have one thing in common: a US idiosyncratic crisis.

And today, US policymakers seem to be doing all they can to generate one.

On the macro front, the US administration is injecting a large amount of uncertainty.

The ‘’no-visibility’’ approach from Trump on tariffs brings big unpredictability – and it’s also nearly impossible for US companies to plan capital expendit

Published on 6 months, 1 week ago